Plasma Component Separator Market based on Technology (Membrane Plasma Separation technique, Centrifugation, and Filtration), End-User (Hospitals, Diagnostic laboratory, Pharmaceutical, and Biotechnological Industry, Blood Banks and Research/ Academic Institutes) and Geography – Global Forecast up to 2027

- July, 2021

- Domain: Healthcare - Medical Devices

- Get Free 10% Customization in this Report

The plasma component separator is used during the diagnosis of blood-associated diseases, and main point of care devices and instruments require a free form of plasma for the performing of diagnostic tests. It results in the elimination of red blood cells from the blood sample. For the research purpose, the centrifugation method is used to separate plasma from the blood. Few devices do not facilitate complete elimination; it remains in the separation matrix. The rising adoption of processed food over natural food is projected to increase the incidence rate of chronic disorders and flawed immune systems among people. This is one of the key reasons to treat the disorders with the help of plasmapheresis, which is anticipated to develop the plasma component separator market over the forecast period. Furthermore, the treatment of diseases through extracorporeal blood circulation can avoid the side effects of other types of treatment. This is also projected to be a key factor fostering the growth of the plasma component separator market during the forecast period. The potential risk of infection owing to substitution fluid may hamper the growth of the plasma component separator market over the forecast period. The Plasma Component Separator Market based is likely to grow at 8.2% CAGR by 2027.

Research Methodology:

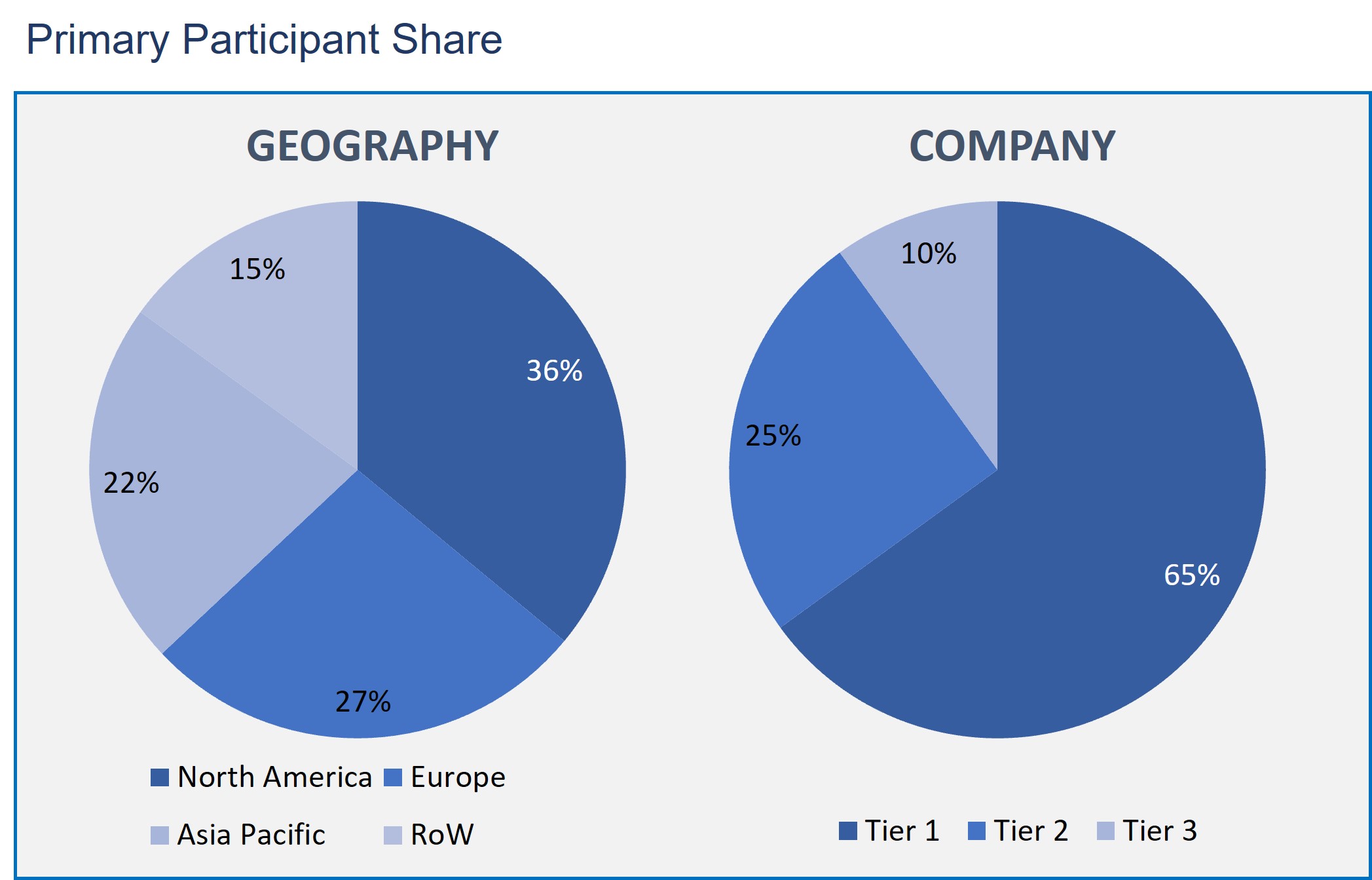

The Plasma Component Separator Market has been analyzed by utilizing the optimum combination of secondary sources and in-house methodology and a unique balance of primary insights. The real-time valuation of the market is an integral part of our forecasting and market sizing methodology. Industry experts and our primary participants have helped to compile related aspects with accurate parametric estimations for a complete study. The primary participants share is given below:

Plasma Component Separator Market based on Technology

- Membrane Plasma Separation technique

- Centrifugation

- Filtration

Plasma Component Separator Market based on End User

- Hospitals

- Diagnostic laboratory

- Pharmaceutical and Biotechnological Industry

- Blood Banks

- Research/ Academic Institutes

Plasma Component Separator Market based on Geography

- North America

- Europe

- Asia Pacific

- Rest of the World

Based on technology, the plasma component separators market is categorized into Membrane Plasma Separation technique, Centrifugation, and Filtration. The centrifugation technology segment is projected to grow at the highest rate during the forecast period. The highest share is attributed to the factors such as advantages provided by centrifugation over membrane separation, and the higher efficacy of centrifugation to separate all types of blood components and the easy way compared to other technologies are propelling the growth of the centrifugation technology market.

On the basis of end-user, the key end-users of the plasma component separators are Hospitals, Diagnostic laboratories, Pharmaceutical, and Biotechnological industries, Blood Banks, and Research/ Academic Institutes. The hospital's segment holds a substantial share in the market. This is due to the rising prevalence and incidence of several blood disorders such as sickle-cell anemia & leukemia. Well-developed healthcare infrastructure will further drive the growth of the the global plasma component separator market in the near future in the hospital segmentation.

As in the market for geographical analysis, the market is classified into North America, Europe, Asia Pacific, and the rest of the world. North America region is likely to account for the extensive market share for the plasma component separator market. This is ascribed to the increasing number of hemophilic patients and companies emphasizing research and development in diagnostics and treatment of blood-associated diseases in the region.

Plasma donation is considered to be an essential component of healthcare. Several medical advances which have enhanced the treatment of serious diseases and injuries have increased the requirement for plasma donation for patients’ survival and maintenance of the patients’ health. The significance of plasma donation in healthcare is realized by the common population around the globe, which has increased the number of people willing to donate their plasma for medical causes. Owing to the aforementioned factors,, the market is likely to grow during the forecast period.

This report covers the top companies of the plasma component separator market Toray Medical Company Ltd, Asahi Kasei Medical Co, Ltd, B Braun Melsungen AG, Kawasumi Laboratories Inc, Fresenius Medical Care, Terumo BCT, Inc., and Haemonetics Corporation.

As a result, the plasma component separation has been becoming a significant aspect in healthcare for treating a various diseases associated with the blood. Thus, plasma protein therapeutics have been determined as the lifesaving therapy for treating various life-threatening diseases.

- This report includes a number of factors driving the growth and impeding the growth of the the plasma component separator market.

- The report features the key vendors' competitive outlook, which include the dynamic strategies including product innovation, merger & acquisitions, partnerships, and joint ventures of the key vendors of the plasma component separator market.

- This report also features the SWOT analysis, portfolio analysis, capability analysis of the significant players of the plasma component separator market.

- This report focuses on the quantitative analysis of the plasma component separator market, which enables users to understand the facts of the market among four major regions.

- Executive Summary

- Industry Outlook

- Industry Overview

- Industry Trends

- Market Snapshot

- Market Definition

- Market Outlook

- Porter Five Forces

- Related Markets

- Market characteristics

- Market Overview

- Market Segmentation

- Market Dynamics

- Drivers

- Restraints

- Opportunities

- DRO - Impact Analysis

- Technology: Market Size & Analysis

- Overview

- Membrane Plasma Separation technique

- Centrifugation

- Filtration

- End-User: Market Size & Analysis

- Overview

- Hospitals

- Diagnostic laboratory

- Pharmaceutical and Biotechnological Industry

- Blood Banks

- Research/ Academic Institutes

- Geography: Market Size & Analysis

- Overview

- North America

- Europe

- Asia Pacific

- Rest of the World

- Competitive Landscape

- Competitor Comparison Analysis

- Market Developments

- Mergers and Acquisitions, Legal, Awards, Partnerships

- Product Launches and execution

- Vendor Profiles

- Toray Medical Company Ltd

- Overview

- Financial Overview

- Product Offerings

- Developments

- Business Strategy

- Asahi Kasei Medical Co, Ltd

- Overview

- Financial Overview

- Product Offerings

- Developments

- Business Strategy

- B Braun Melsungen AG

- Overview

- Financial Overview

- Product Offerings

- Developments

- Business Strategy

- Kawasumi Laboratories Inc

- Overview

- Financial Overview

- Product Offerings

- Developments

- Business Strategy

- Fresenius Medical Care

- Overview

- Financial Overview

- Product Offerings

- Developments

- Business Strategy

- Terumo BCT, Inc.

- Overview

- Financial Overview

- Product Offerings

- Developments

- Business Strategy

- Haemonetics Corporation

- Overview

- Financial Overview

- Product Offerings

- Developments

- Business Strategy

- Toray Medical Company Ltd

- Analyst Opinion

- Annexure

- Report Scope

- Market Definitions

- Research Methodology

- Data Collation and In-house Estimation

- Market Triangulation

- Forecasting

- Report Assumptions

- Declarations

- Stakeholders

- Abbreviations

TABLE 1. GLOBAL PLASMA COMPONENT SEPARATOR MARKET VALUE, BY TECHNOLOGY, 2021-2026 (USD BILLION)

TABLE 2. GLOBAL PLASMA COMPONENT SEPARATOR MARKET VALUE FOR MEMBRANE PLASMA SEPARATION TECHNIQUE, BY GEOGRAPHY, 2021-2027 (USD BILLION)

TABLE 3. GLOBAL PLASMA COMPONENT SEPARATOR MARKET VALUE FOR CENTRIFUGATION, BY GEOGRAPHY, 2021-2027 (USD BILLION)

TABLE 4. GLOBAL PLASMA COMPONENT SEPARATOR MARKET VALUE FOR FILTRATION, BY GEOGRAPHY, 2021-2027 (USD BILLION)

TABLE 5. GLOBAL PLASMA COMPONENT SEPARATOR MARKET VALUE, BY END-USER, 2021-2027 (USD BILLION)

TABLE 6. GLOBAL PLASMA COMPONENT SEPARATOR MARKET VALUE FOR HOSPITALS, 2021-2027 (USD BILLION)

TABLE 7. GLOBAL PLASMA COMPONENT SEPARATOR MARKET VALUE FOR DIAGNOSTIC LABORATORY, BY GEOGRAPHY, 2021-2027 (USD BILLION)

TABLE 8. GLOBAL PLASMA COMPONENT SEPARATOR MARKET VALUE FOR PHARMACEUTICAL AND BIOTECHNOLOGICAL INDUSTRY, BY GEOGRAPHY, 2021-2027 (USD BILLION)

TABLE 9. GLOBAL PLASMA COMPONENT SEPARATOR MARKET VALUE FOR BLOOD BANKS, BY GEOGRAPHY, 2021-2027 (USD BILLION)

TABLE 10. GLOBAL PLASMA COMPONENT SEPARATOR MARKET VALUE FOR RESEARCH/ ACADEMIC INSTITUTES, BY GEOGRAPHY, 2021-2027 (USD BILLION)

TABLE 11. NORTH AMERICA PLASMA COMPONENT SEPARATOR MARKET VALUE, BY COUNTRY, 2021-2027 (USD BILLION)

TABLE 12. NORTH AMERICA PLASMA COMPONENT SEPARATOR MARKET VALUE, BY TECHNOLOGY, 2021-2027 (USD BILLION)

TABLE 13. NORTH AMERICA PLASMA COMPONENT SEPARATOR MARKET VALUE, BY END-USER, 2021-2027 (USD BILLION)

TABLE 14. U.S PLASMA COMPONENT SEPARATOR MARKET VALUE, BY TECHNOLOGY, 2021-2027 (USD BILLION)

TABLE 15. U.S PLASMA COMPONENT SEPARATOR MARKET VALUE, BY END-USER, 2021-2027 (USD BILLION)

TABLE 16. CANADA PLASMA COMPONENT SEPARATOR MARKET VALUE, BY TECHNOLOGY, 2021-2027 (USD BILLION)

TABLE 17. CANADA PLASMA COMPONENT SEPARATOR MARKET VALUE, BY END-USER, 2021-2027 (USD BILLION)

TABLE 18. EUROPE PLASMA COMPONENT SEPARATOR MARKET VALUE, BY COUNTRY, 2021-2027 (USD BILLION)

TABLE 19. EUROPE PLASMA COMPONENT SEPARATOR MARKET VALUE, BY TECHNOLOGY, 2021-2027 (USD BILLION)

TABLE 20. EUROPE PLASMA COMPONENT SEPARATOR MARKET VALUE, END-USER, 2021-2027 (USD BILLION)

TABLE 21. GERMANY PLASMA COMPONENT SEPARATOR MARKET VALUE, BY TECHNOLOGY, 2021-2027 (USD BILLION)

TABLE 22. GERMANY PLASMA COMPONENT SEPARATOR MARKET VALUE, BY END-USER, 2021-2027 (USD BILLION)

TABLE 23. U.K PLASMA COMPONENT SEPARATOR MARKET VALUE, BY TECHNOLOGY, 2021-2027 (USD BILLION)

TABLE 24. U.K PLASMA COMPONENT SEPARATOR MARKET VALUE, BY END-USER, 2021-2027 (USD BILLION)

TABLE 25. FRANCE PLASMA COMPONENT SEPARATOR MARKET VALUE, BY TECHNOLOGY, 2021-2027 (USD BILLION)

TABLE 26. FRANCE PLASMA COMPONENT SEPARATOR MARKET VALUE, BY END-USER, 2021-2027 (USD BILLION)

TABLE 27. ITALY PLASMA COMPONENT SEPARATOR MARKET VALUE, BY TECHNOLOGY, 2021-2027 (USD BILLION)

TABLE 28. ITALY PLASMA COMPONENT SEPARATOR MARKET VALUE, BY END-USER, 2021-2027 (USD BILLION)

TABLE 29. SPAIN PLASMA COMPONENT SEPARATOR MARKET VALUE, BY TECHNOLOGY, 2021-2027 (USD BILLION)

TABLE 30. SPAIN PLASMA COMPONENT SEPARATOR MARKET VALUE, BY END-USER, 2021-2027 (USD BILLION)

TABLE 31. ROE PLASMA COMPONENT SEPARATOR MARKET VALUE, BY TECHNOLOGY, 2021-2027 (USD BILLION)

TABLE 32. ROE PLASMA COMPONENT SEPARATOR MARKET VALUE, BY END-USER, 2021-2027 (USD BILLION)

TABLE 33. ASIA PACIFIC PLASMA COMPONENT SEPARATOR MARKET VALUE, BY COUNTRY, 2021-2027 (USD BILLION)

TABLE 34. ASIA PACIFIC PLASMA COMPONENT SEPARATOR MARKET VALUE, BY TECHNOLOGY, 2021-2027 (USD BILLION)

TABLE 35. ASIA PACIFIC PLASMA COMPONENT SEPARATOR MARKET VALUE, BY END-USER, 2021-2027 (USD BILLION)

TABLE 36. CHINA PLASMA COMPONENT SEPARATOR MARKET VALUE, BY TECHNOLOGY, 2021-2027 (USD BILLION)

TABLE 37. CHINA PLASMA COMPONENT SEPARATOR MARKET VALUE, BY END-USER, 2021-2027 (USD BILLION)

TABLE 38. INDIA PLASMA COMPONENT SEPARATOR MARKET VALUE, BY TECHNOLOGY, 2021-2027 (USD BILLION)

TABLE 39. INDIA PLASMA COMPONENT SEPARATOR MARKET VALUE, BY END-USER, 2021-2027 (USD BILLION)

TABLE 40. JAPAN PLASMA COMPONENT SEPARATOR MARKET VALUE, BY TECHNOLOGY, 2021-2027 (USD BILLION)

TABLE 41. JAPAN PLASMA COMPONENT SEPARATOR MARKET VALUE, BY END-USER, 2021-2027 (USD BILLION)

TABLE 42. REST OF APAC PLASMA COMPONENT SEPARATOR MARKET VALUE, BY TECHNOLOGY, 2021-2027 (USD BILLION)

TABLE 43. REST OF APAC PLASMA COMPONENT SEPARATOR MARKET VALUE, BY END-USER, 2021-2027 (USD BILLION)

TABLE 44. REST OF WORLD PLASMA COMPONENT SEPARATOR MARKET VALUE, BY TECHNOLOGY, 2021-2027 (USD BILLION)

TABLE 45. REST OF WORLD PLASMA COMPONENT SEPARATOR MARKET VALUE, BY END-USER, 2021-2027 (USD BILLION)

TABLE 46. TORAY MEDICAL COMPANY LTD: FINANCIALS

TABLE 47. TORAY MEDICAL COMPANY LTD: PRODUCTS & SERVICES

TABLE 48. TORAY MEDICAL COMPANY LTD: RECENT DEVELOPMENTS

TABLE 49. ASAHI KASEI MEDICAL CO, LTD: FINANCIALS

TABLE 50. ASAHI KASEI MEDICAL CO, LTD: PRODUCTS & SERVICES

TABLE 51. ASAHI KASEI MEDICAL CO, LTD: RECENT DEVELOPMENTS

TABLE 52. B BRAUN MELSUNGEN AG: FINANCIALS

TABLE 53. B BRAUN MELSUNGEN AG: PRODUCTS & SERVICES

TABLE 54. B BRAUN MELSUNGEN AG: RECENT DEVELOPMENTS

TABLE 55. KAWASUMI LABORATORIES INC: FINANCIALS

TABLE 56. KAWASUMI LABORATORIES INC: PRODUCTS & SERVICES

TABLE 57. KAWASUMI LABORATORIES INC: RECENT DEVELOPMENTS

TABLE 58. FRESENIUS MEDICAL CARE: FINANCIALS

TABLE 59. FRESENIUS MEDICAL CARE: PRODUCTS & SERVICES

TABLE 60. FRESENIUS MEDICAL CARE: RECENT DEVELOPMENTS

TABLE 61. TERUMO BCT, INC.: FINANCIALS

TABLE 62. TERUMO BCT, INC.: PRODUCTS & SERVICES

TABLE 63. TERUMO BCT, INC.: RECENT DEVELOPMENTS

TABLE 64. HAEMONETICS CORPORATION: FINANCIALS

TABLE 65. HAEMONETICS CORPORATION: PRODUCTS & SERVICES

TABLE 66. HAEMONETICS CORPORATION: RECENT DEVELOPMENTS

Research Framework

Infoholic Research works on a holistic 360° approach in order to deliver high quality, validated and reliable information in our market reports. The Market estimation and forecasting involves following steps:

- Data Collation (Primary & Secondary)

- In-house Estimation (Based on proprietary data bases and Models)

- Market Triangulation

- Forecasting

Market related information is congregated from both primary and secondary sources.

Primary sources

Involved participants from all global stakeholders such as Solution providers, service providers, Industry associations, thought leaders etc. across levels such as CXOs, VPs and managers. Plus, our in-house industry experts having decades of industry experience contribute their consulting and advisory services.

Secondary sources

Include public sources such as regulatory frameworks, government IT spending, government demographic indicators, industry association statistics, and company publications along with paid sources such as Factiva, OneSource, Bloomberg among others.