Microprocessor and GPU Market based on Product (X86, ARM, and MIPS), GPU Type (Discrete and Integrated), Application (Home Appliance, Server, BFSI, Aerospace Defense, Medical, Industry and Other), and Geography –Global Forecast to 2027

- July, 2021

- Domain: Electronics & Semiconductors - Electronics & Semiconductors

- Get Free 10% Customization in this Report

The microprocessor is an electronic component of a computer system that performs arithmetic and logic operations, including adding, subtracting, moving numbers from one area to another, and comparing two numbers. On the other hand, GPU or graphics processing units is a specialized circuit designed to rapidly alter and manipulate the memory, which helps obtain the momentum for creating the image. It is a vital part of modern computer systems and even for lightweight laptops. The development in the microprocessor and GPU systems’ architecture for several purpose computing is majorly responsible for the robust growth of the microprocessor and GPU market. GPU accelerated computing has come a long way in a short time, like line up with the current technological trends. With the incorporation of increased generality, reduced energy, and PGAS memory, the demand for GPUs has increased for HPC programming and other uses, which has fueled the market's growth. However, the rising attraction towards portable devices over big computing devices is a key factor that is expected to impede the market's growth. The Microprocessor and GPU Market is anticipated to grow at the rate of 6.2% CAGR by 2027.

Research Methodology:

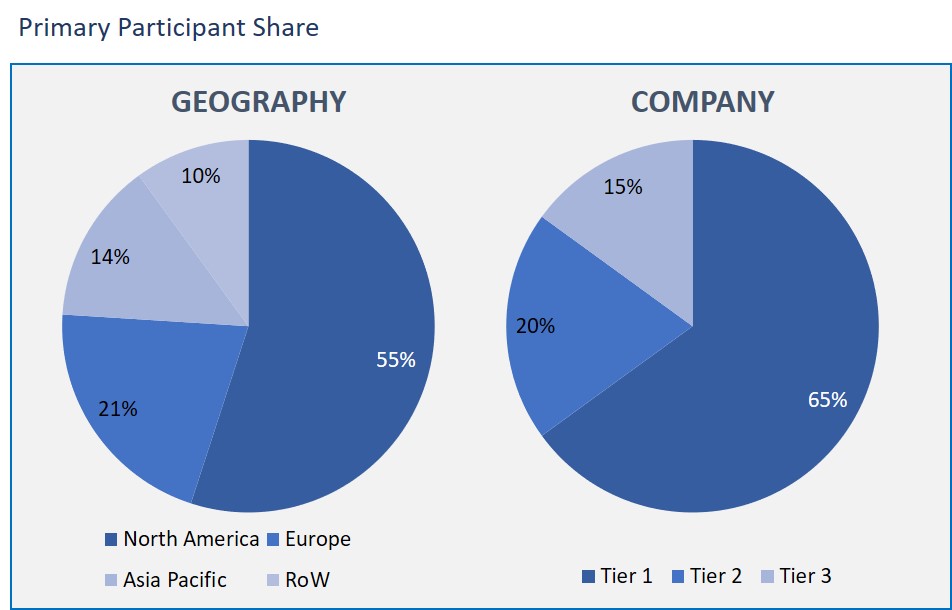

The Microprocessor and GPU Market has been analyzed by utilizing the optimum combination of secondary sources and in-house methodology and a unique balance of primary insights. The real-time valuation of the market is an integral part of our forecasting and market sizing methodology. Industry experts and our primary participants have helped to compile related aspects with accurate parametric estimations for a complete study. The primary participants share is given below:

Microprocessor and GPU Market based on Product

- X86

- ARM

- MIPS

Microprocessor and GPU Market based on GPU Type

- Discrete

- Integrated

Microprocessor and GPU Market based on Application

- Home Appliance

- Server

- BFSI

- Aerospace Defense

- Medical

- Industry

- Other

Microprocessor and GPU Market based on Geography

- North America

- Europe

- Asia Pacific

- Rest of the World

As per the product, the x86 is projected to command the global microprocessor and GPU market over the forecast period. Since x86 is one of the most advanced microprocessors, which comprises more than 820 million transistors, it leads to an escalated demand as used in a personal computer. The current developments in the performance capabilities are majorly responsible for the growth of the segment.

The discrete GPUs segment has a significant share based on GPU type in the market. Discrete GPUs are appropriate for visualization, gaming, animation, video rendering, and other graphic-intensive applications. These GPUs provide potentially high-performance abilities, a smooth image processing experience, and provide seamless gaming. The demand for discrete GPUs has increased briskly with the deployment of advanced technologies, such as machine learning (ML) and deep learning, since they are widely used in advanced driver assistance systems (ADAS), computing-intensive servers, and the infotainment system in an automobile.

The industrial segment is projected to witness the highest growth in the forecast period based on the application. The factor that can be ascribed to the segment's growth is related to the rising adoption of industrial PCs, which can process data at a rapid speed. These IPCs are robust to withstand severe industrial conditions such as temperature, weight, vibration, and humidity. Due to the severe environment, GPUS used in these PCs is of high quality, with augmented computational speed to manage fast processing.

Based on geography, the Asia Pacific is witnessing substantial growth in the coming years. This is due to an increase in the adoption of technologies that allow digital transformation, including artificial intelligence, deep learning, and the Internet of Things across several sectors such as automotive, consumer electronics, healthcare, and industrial has stimulated the demand for microprocessors and GPU in the APAC region.

The demand for inference systems and deep learning has increased among various sectors, such as automated driving and electronic devices for industrial automation. Deep learning is used for automated hearing applications in smart devices, such as smart speakers and smart TVs, which has propelled the microprocessor and GPU market players to increase the capacity, directly correlated to the growth of the global market.

The following companies are leading the market-SAPPHIRE Technology Limited, Qualcomm Technologies, Inc., Advanced Micro Devices, Inc, Renesas Electronics Corporation, NXP Semiconductors, Imagination Technologies Limited, ASUSTeK Computer Inc, VIA Technologies, Inc., Intel Corporation, and IBM Corporation.

Therefore, nowadays, the microprocessors not only consist of complex microarchitectures and multiple execution engines but have grown to include all types of additional functions. Moreover, GPUs also have a significant role in smart devices, wearables, tablets, and many more applications.

- The microprocessors and GPUs market report includes the comparative estimations of the whole and segment-based market sizes among product, GPU type, applications, and geography.

- The report also consists of the market's pulse and mentions major propellants, restraints, challenges, and opportunities impacting the market growth.

- This report gives the competitive outlook, which consists of a competitive analysis of leading players and strategies such as product introduction and developments, acquisitions, collaborations, partnerships, and diversifications adopted by key market vendors.

- Executive Summary

- Industry Outlook

- Industry Overview

- Industry Trends

- Market Snapshot

- Market Definition

- Market Outlook

- Porter Five Forces

- Related Markets

- Market characteristics

- Market Overview

- Market Segmentation

- Market Dynamics

- Drivers

- Restraints

- Opportunities

- DRO - Impact Analysis

- Product: Market Size & Analysis

- Overview

- X86

- ARM

- MIPS

- GPU Type: Market Size & Analysis

- Overview

- Discrete

- Integrated

- Application: Market Size & Analysis

- Overview

- Home Appliance

- Server

- BFSI

- Aerospace Defense

- Medical

- Industry

- Other

- Geography: Market Size & Analysis

- Overview

- North America

- Europe

- Asia Pacific

- Rest of the World

- Competitive Landscape

- Competitor Comparison Analysis

- Market Developments

- Mergers and Acquisitions, Legal, Awards, Partnerships

- Product Launches and execution

- Vendor Profiles

- SAPPHIRE Technology Limited

- Overview

- Financial Overview

- Product Offerings

- Developments

- Business Strategy

- Qualcomm Technologies, Inc.

- Overview

- Financial Overview

- Product Offerings

- Developments

- Business Strategy

- Advanced Micro Devices, Inc

- Overview

- Financial Overview

- Product Offerings

- Developments

- Business Strategy

- Renesas Electronics Corporation

- Overview

- Financial Overview

- Product Offerings

- Developments

- Business Strategy

- NXP Semiconductors

- Overview

- Financial Overview

- Product Offerings

- Developments

- Business Strategy

- Imagination Technologies Limited

- Overview

- Financial Overview

- Product Offerings

- Developments

- Business Strategy

- ASUSTeK Computer Inc

- Overview

- Financial Overview

- Product Offerings

- Developments

- Business Strategy

- VIA Technologies, Inc.

- Overview

- Financial Overview

- Product Offerings

- Developments

- Business Strategy

- Intel Corporation

- Overview

- Financial Overview

- Product Offerings

- Developments

- Business Strategy

- IBM Corporation

- Overview

- Financial Overview

- Product Offerings

- Developments

- Business Strategy

- SAPPHIRE Technology Limited

- Analyst Opinion

- Annexure

- Report Scope

- Market Definitions

- Research Methodology

- Data Collation and In-house Estimation

- Market Triangulation

- Forecasting

- Report Assumptions

- Declarations

- Stakeholders

- Abbreviations

TABLE 1. GLOBAL MICROPROCESSOR AND GPU MARKET VALUE, BY PRODUCT, 2021-2027 (USD BILLION)

TABLE 2. GLOBAL MICROPROCESSOR AND GPU MARKET VALUE FOR X86, BY GEOGRAPHY, 2021-2027 (USD BILLION)

TABLE 3. GLOBAL MICROPROCESSOR AND GPU MARKET VALUE FOR ARM, BY GEOGRAPHY, 2021-2027 (USD BILLION)

TABLE 4. GLOBAL MICROPROCESSOR AND GPU MARKET VALUE FOR MIPS, BY GEOGRAPHY, 2021-2027 (USD BILLION)

TABLE 5. GLOBAL MICROPROCESSOR AND GPU MARKET VALUE, BY GPU TYPE, BY GEOGRAPHY, 2021-2027 (USD BILLION)

TABLE 6. GLOBAL MICROPROCESSOR AND GPU MARKET VALUE FOR DISCRETE, BY GEOGRAPHY, 2021-2027 (USD BILLION)

TABLE 7. GLOBAL MICROPROCESSOR AND GPU MARKET VALUE FOR INTEGRATED, BY GEOGRAPHY, 2021-2027 (USD BILLION)

TABLE 8. GLOBAL MICROPROCESSOR AND GPU MARKET VALUE, BY APPLICATION, 2021-2027 (USD BILLION)

TABLE 9. GLOBAL MICROPROCESSOR AND GPU MARKET VALUE FOR HOME APPLIANCE, BY GEOGRAPHY, 2021-2027 (USD BILLION)

TABLE 10. GLOBAL MICROPROCESSOR AND GPU MARKET VALUE FOR SERVER, BY GEOGRAPHY, 2021-2027 (USD BILLION)

TABLE 11. GLOBAL MICROPROCESSOR AND GPU MARKET VALUE FOR BFSI, BY GEOGRAPHY, 2021-2027 (USD BILLION)

TABLE 12. GLOBAL MICROPROCESSOR AND GPU MARKET VALUE FOR AEROSPACE DEFENSE, BY GEOGRAPHY, 2021-2027 (USD BILLION)

TABLE 13. GLOBAL MICROPROCESSOR AND GPU MARKET VALUE FOR MEDICAL, BY GEOGRAPHY, 2021-2027 (USD BILLION)

TABLE 14. GLOBAL MICROPROCESSOR AND GPU MARKET VALUE FOR INDUSTRY, BY GEOGRAPHY, 2021-2027 (USD BILLION)

TABLE 15. GLOBAL MICROPROCESSOR AND GPU MARKET VALUE FOR OTHER, BY GEOGRAPHY, 2021-2027 (USD BILLION)

TABLE 16. NORTH AMERICA MICROPROCESSOR AND GPU MARKET VALUE, BY COUNTRY, 2021-2027 (USD BILLION)

TABLE 17. NORTH AMERICA MICROPROCESSOR AND GPU MARKET VALUE, BY PRODUCT, 2021-2027 (USD BILLION)

TABLE 18. NORTH AMERICA MICROPROCESSOR AND GPU MARKET VALUE, BY GPU TYPE, 2021-2027 (USD BILLION)

TABLE 19. NORTH AMERICA MICROPROCESSOR AND GPU MARKET VALUE, BY APPLICATION, 2021-2027 (USD BILLION)

TABLE 20. U.S MICROPROCESSOR AND GPU MARKET VALUE, BY PRODUCT, 2021-2027 (USD BILLION)

TABLE 21. U.S MICROPROCESSOR AND GPU MARKET VALUE, BY GPU TYPE, 2021-2027 (USD BILLION)

TABLE 22. U.S MICROPROCESSOR AND GPU MARKET VALUE, BY APPLICATION, 2021-2027 (USD BILLION)

TABLE 23. CANADA MICROPROCESSOR AND GPU MARKET VALUE, BY PRODUCT, 2021-2027 (USD BILLION)

TABLE 24. CANADA MICROPROCESSOR AND GPU MARKET VALUE, BY GPU TYPE, 2021-2027 (USD BILLION)

TABLE 25. CANADA MICROPROCESSOR AND GPU MARKET VALUE, BY APPLICATION, 2021-2027 (USD BILLION)

TABLE 26. EUROPE MICROPROCESSOR AND GPU MARKET VALUE, BY COUNTRY, 2021-2027 (USD BILLION)

TABLE 27. EUROPE MICROPROCESSOR AND GPU MARKET VALUE, BY PRODUCT, 2021-2027 (USD BILLION)

TABLE 28. EUROPE MICROPROCESSOR AND GPU MARKET VALUE, BY GPU TYPE, 2021-2027 (USD BILLION)

TABLE 29. EUROPE MICROPROCESSOR AND GPU MARKET VALUE, APPLICATION, 2021-2027 (USD BILLION)

TABLE 30. GERMANY MICROPROCESSOR AND GPU MARKET VALUE, BY PRODUCT, 2021-2027 (USD BILLION)

TABLE 31. GERMANY MICROPROCESSOR AND GPU MARKET VALUE, BY GPU TYPE, 2021-2027 (USD BILLION)

TABLE 32. GERMANY MICROPROCESSOR AND GPU MARKET VALUE, BY APPLICATION, 2021-2027 (USD BILLION)

TABLE 33. U.K MICROPROCESSOR AND GPU MARKET VALUE, BY PRODUCT, 2021-2027 (USD BILLION)

TABLE 34. U.K MICROPROCESSOR AND GPU MARKET VALUE, BY GPU TYPE, 2021-2027 (USD BILLION)

TABLE 35. U.K MICROPROCESSOR AND GPU MARKET VALUE, BY APPLICATION, 2021-2027 (USD BILLION)

TABLE 36. FRANCE MICROPROCESSOR AND GPU MARKET VALUE, BY PRODUCT, 2021-2027 (USD BILLION)

TABLE 37. FRANCE MICROPROCESSOR AND GPU MARKET VALUE, BY GPU TYPE, 2021-2027 (USD BILLION)

TABLE 38. FRANCE MICROPROCESSOR AND GPU MARKET VALUE, BY APPLICATION, 2021-2027 (USD BILLION)

TABLE 39. ITALY MICROPROCESSOR AND GPU MARKET VALUE, BY PRODUCT, 2021-2027 (USD BILLION)

TABLE 40. ITALY MICROPROCESSOR AND GPU MARKET VALUE, BY GPU TYPE, 2021-2027 (USD BILLION)

TABLE 41. ITALY MICROPROCESSOR AND GPU MARKET VALUE, BY APPLICATION, 2021-2027 (USD BILLION)

TABLE 42. SPAIN MICROPROCESSOR AND GPU MARKET VALUE, BY PRODUCT, 2021-2027 (USD BILLION)

TABLE 43. SPAIN MICROPROCESSOR AND GPU MARKET VALUE, BY GPU TYPE, 2021-2027 (USD BILLION)

TABLE 44. SPAIN MICROPROCESSOR AND GPU MARKET VALUE, BY APPLICATION, 2021-2027 (USD BILLION)

TABLE 45. ROE MICROPROCESSOR AND GPU MARKET VALUE, BY PRODUCT, 2021-2027 (USD BILLION)

TABLE 46. ROE MICROPROCESSOR AND GPU MARKET VALUE, BY GPU TYPE, 2021-2027 (USD BILLION)

TABLE 47. ROE MICROPROCESSOR AND GPU MARKET VALUE, BY APPLICATION, 2021-2027 (USD BILLION)

TABLE 48. ASIA PACIFIC MICROPROCESSOR AND GPU MARKET VALUE, BY COUNTRY, 2021-2027 (USD BILLION)

TABLE 49. ASIA PACIFIC MICROPROCESSOR AND GPU MARKET VALUE, BY PRODUCT, 2021-2027 (USD BILLION)

TABLE 50. ASIA PACIFIC MICROPROCESSOR AND GPU MARKET VALUE, BY GPU TYPE, 2021-2027 (USD BILLION)

TABLE 51. ASIA PACIFIC MICROPROCESSOR AND GPU MARKET VALUE, BY APPLICATION, 2021-2027 (USD BILLION)

TABLE 52. CHINA MICROPROCESSOR AND GPU MARKET VALUE, BY PRODUCT, 2021-2027 (USD BILLION)

TABLE 53. CHINA MICROPROCESSOR AND GPU MARKET VALUE, BY GPU TYPE, 2021-2027 (USD BILLION)

TABLE 54. CHINA MICROPROCESSOR AND GPU MARKET VALUE, BY APPLICATION, 2021-2027 (USD BILLION)

TABLE 55. INDIA MICROPROCESSOR AND GPU MARKET VALUE, BY PRODUCT, 2021-2027 (USD BILLION)

TABLE 56. INDIA MICROPROCESSOR AND GPU MARKET VALUE, BY GPU TYPE, 2021-2027 (USD BILLION)

TABLE 57. INDIA MICROPROCESSOR AND GPU MARKET VALUE, BY APPLICATION, 2021-2027 (USD BILLION)

TABLE 58. JAPAN MICROPROCESSOR AND GPU MARKET VALUE, BY PRODUCT, 2021-2027 (USD BILLION)

TABLE 59. JAPAN MICROPROCESSOR AND GPU MARKET VALUE, BY GPU TYPE, 2021-2027 (USD BILLION)

TABLE 60. JAPAN MICROPROCESSOR AND GPU MARKET VALUE, BY APPLICATION, 2021-2027 (USD BILLION)

TABLE 61. REST OF APAC MICROPROCESSOR AND GPU MARKET VALUE, BY PRODUCT, 2021-2027 (USD BILLION)

TABLE 62. REST OF APAC MICROPROCESSOR AND GPU MARKET VALUE, BY GPU TYPE, 2021-2027 (USD BILLION)

TABLE 63. REST OF APAC MICROPROCESSOR AND GPU MARKET VALUE, BY APPLICATION, 2021-2027 (USD BILLION)

TABLE 64. REST OF WORLD MICROPROCESSOR AND GPU MARKET VALUE, BY PRODUCT, 2021-2027 (USD BILLION)

TABLE 65. REST OF WORLD MICROPROCESSOR AND GPU MARKET VALUE, BY GPU TYPE, 2021-2027 (USD BILLION)

TABLE 66. REST OF WORLD MICROPROCESSOR AND GPU MARKET VALUE, BY APPLICATION, 2021-2027 (USD BILLION)

TABLE 67. SAPPHIRE TECHNOLOGY LIMITED: FINANCIALS

TABLE 68. SAPPHIRE TECHNOLOGY LIMITED: PRODUCTS & SERVICES

TABLE 69. SAPPHIRE TECHNOLOGY LIMITED: RECENT DEVELOPMENTS

TABLE 70. QUALCOMM TECHNOLOGIES, INC: FINANCIALS

TABLE 71. QUALCOMM TECHNOLOGIES, INC: PRODUCTS & SERVICES

TABLE 72. QUALCOMM TECHNOLOGIES, INC: RECENT DEVELOPMENTS

TABLE 73. ADVANCED MICRO DEVICES, INC: FINANCIALS

TABLE 74. ADVANCED MICRO DEVICES, INC: PRODUCTS & SERVICES

TABLE 75. ADVANCED MICRO DEVICES, INC: RECENT DEVELOPMENTS

TABLE 76. RENESAS ELECTRONICS CORPORATION: FINANCIALS

TABLE 77. RENESAS ELECTRONICS CORPORATION: PRODUCTS & SERVICES

TABLE 78. RENESAS ELECTRONICS CORPORATION: RECENT DEVELOPMENTS

TABLE 79. NXP SEMICONDUCTORS: FINANCIALS

TABLE 80. NXP SEMICONDUCTORS: PRODUCTS & SERVICES

TABLE 81. NXP SEMICONDUCTORS: RECENT DEVELOPMENTS

TABLE 82. IMAGINATION TECHNOLOGIES LIMITED: FINANCIALS

TABLE 83. IMAGINATION TECHNOLOGIES LIMITED: PRODUCTS & SERVICES

TABLE 84. IMAGINATION TECHNOLOGIES LIMITED: RECENT DEVELOPMENTS

TABLE 85. ASUSTEK COMPUTER INC: FINANCIALS

TABLE 86. ASUSTEK COMPUTER INC: PRODUCTS & SERVICES

TABLE 87. ASUSTEK COMPUTER INC: RECENT DEVELOPMENTS

TABLE 88. VIA TECHNOLOGIES, INC: FINANCIALS

TABLE 89. VIA TECHNOLOGIES, INC: PRODUCTS & SERVICES

TABLE 90. VIA TECHNOLOGIES, INC: RECENT DEVELOPMENTS

TABLE 91. INTEL CORPORATION: FINANCIALS

TABLE 92. INTEL CORPORATION: PRODUCTS & SERVICES

TABLE 93. INTEL CORPORATION: RECENT DEVELOPMENTS

TABLE 94. IBM CORPORATION: FINANCIALS

TABLE 95. IBM CORPORATION: PRODUCTS & SERVICES

TABLE 96. IBM CORPORATION: RECENT DEVELOPMENTS

Research Framework

Infoholic Research works on a holistic 360° approach in order to deliver high quality, validated and reliable information in our market reports. The Market estimation and forecasting involves following steps:

- Data Collation (Primary & Secondary)

- In-house Estimation (Based on proprietary data bases and Models)

- Market Triangulation

- Forecasting

Market related information is congregated from both primary and secondary sources.

Primary sources

Involved participants from all global stakeholders such as Solution providers, service providers, Industry associations, thought leaders etc. across levels such as CXOs, VPs and managers. Plus, our in-house industry experts having decades of industry experience contribute their consulting and advisory services.

Secondary sources

Include public sources such as regulatory frameworks, government IT spending, government demographic indicators, industry association statistics, and company publications along with paid sources such as Factiva, OneSource, Bloomberg among others.