Cardiovascular Devices Market by Device (Diagnostic and Monitoring Devices, Therapeutic and Surgical Devices, and Others), Application (Coronary Heart Disease, Sudden Cardiac Arrest, Stroke, Cerebrovascular Heart Disease, and Others), End-User (Hospitals, Ambulatory Surgical Centers and Cardiac Centers) and Geography – Global Forecast to 2027

- July, 2021

- Domain: Healthcare - Medical Devices

- Get Free 10% Customization in this Report

Cardiovascular devices can diagnose and treat several heart diseases and associated heart problems. Cardiovascular diseases or CVDs have long been determined as the top pain points of the medical industry. With conditions such as stroke or IHD (ischemic heart disease) is a crucial reason for mortality and disability worldwide, cardiovascular devices and their prominence in heart-related therapies are rapidly being brought into the limelight. Surging awareness and demand for minimally invasive surgeries will enhance the market growth in the coming years. Advantages such as small incisions, reduced risk of infection, and relatively less time consumption are the factors that fuel the patient preference for these procedures. In addition, technological advancements in cardiovascular devices provide effective solutions for such minimally invasive procedures. The ongoing technological developments towards miniaturization, material biocompatibility of implantable, and advanced navigation devices are projected to enhance the Cardiovascular devices market growth during the forecast year. The increased risk related to cardiac procedures is likely to hamper the cardiovascular devices market growth. The Cardiovascular Devices Market is likely to grow at the rate of 16.6% CAGR by 2027.

Research Methodology:

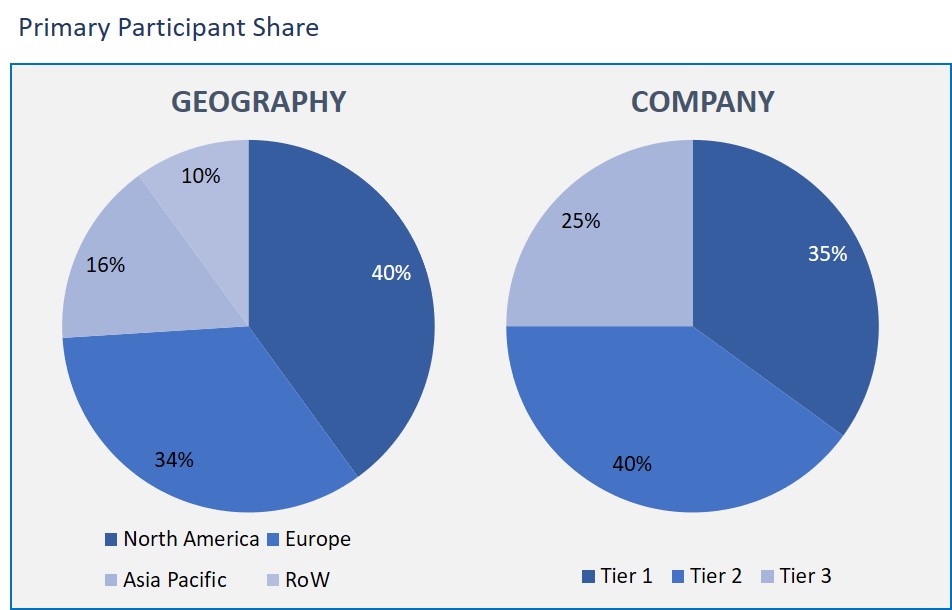

The Cardiovascular devices Market has been analyzed by utilizing the optimum combination of secondary sources and in-house methodology and a unique balance of primary insights. The real-time valuation of the market is an integral part of our forecasting and market sizing methodology. Industry experts and our primary participants have helped to compile related aspects with accurate parametric estimations for a complete study. The primary participants share is given below:

Cardiovascular Devices Market based on Device

- Diagnostic and Monitoring Devices

- Therapeutic and Surgical Devices

- Others

Cardiovascular Devices Market based on Application

- Coronary Heart Disease

- Sudden Cardiac Arrest

- Stroke

- Cerebrovascular Heart Disease

- Others

Cardiovascular Devices Market based on End-User

- Hospitals

- Ambulatory Surgical Centers

- Cardiac Centers

Cardiovascular Devices Market based on Geography

- North America

- Europe

- Asia Pacific

- Rest of the World

As per the market by device, the diagnostic and monitoring devices segment is likely to have major growth in the coming years. This is due to the growing number of local and regional players in the global market contributing to the elevating demand for advanced cardiac device therapeutic purposes. Moreover, under diagnostic and monitoring devices, ECG devices are being majorly used in cardiovascular diseases.

As per the market by application, cardiovascular devices are majorly applicable in coronary heart disease, a segment to hold a largest share in the market. This is due to the presence of the devices that include coronary stents used to treat coronary heart disease, which includes the narrowing of the arteries and may result in other cardiac conditions such as heart attacks.

Further, based on end-users, the prominent end-users having a major role in the market growth are hospitals. This is due to the increasing requirement for trained medical professionals to install vital cardiovascular devices such as stents. In addition, the hospitals are considered to provide medical procedures such as installing stents with minimum adverse reactions in patients.

As per the geographical analysis, North America accounted to acquire a substantial share of the market. The substantial share is ascribed to the key manufacturer’s presence in the region, high incidence of cardiovascular diseases, and Canada, the major factor for the expansion of the market.

Cardiovascular diseases (CVDs) are probable to remain the major cause of morbidity and mortality worldwide. The CVDs are the heart and blood vessels' disorders and include coronary heart disease, cerebrovascular disease, rheumatic heart disease, and other conditions. Therefore, some of the key lifestyle factors that result in cardiovascular disease and difficulties are unhealthy diet, tobacco, and physical inactivity, which increases the risk of heart attacks and strokes. Thus, the above factor is stimulating the global cardiovascular devices market growth.

Few notable vendors of the cardiovascular devices market are Medtronic, Boston, B. Braun Melsungen AG, Becton, Dickinson and Company, General Electric Company, Biosense Webster, Inc (Johnson and Johnson), Scientific Corporation, Abbott Laboratories, Koninklijke Philips N.V, Siemens AG, and Edwards Lifesciences Corporation.

Henceforth, cardiovascular devices are having a prominent role in the rising number of cardiovascular diseases scenario. Cardiovascular diseases have become most common among individuals, and cardiovascular devices have many benefits, including minimally invasive devices.

- Several factors are included in the study, which is impacting the market growth and restricting the market.

- This report consists of the segmentation and sub-segmentations and the segment’s contribution to the market growth.

- The report also includes the profiles of the key vendors in the market and their strategies, such as product launches, company expansions, and acquisitions.

- Further, the report depicts the penetration of the market in the various regions.

- Executive Summary

- Industry Outlook

- Industry Overview

- Industry Trends

- Market Snapshot

- Market Definition

- Market Outlook

- Porter Five Forces

- Related Markets

- Market characteristics

- Market Overview

- Market Segmentation

- Market Dynamics

- Drivers

- Restraints

- Opportunities

- DRO - Impact Analysis

- Device: Market Size & Analysis

- Overview

- Diagnostic and Monitoring Devices

- Therapeutic and Surgical Devices

- Others

- Application: Market Size & Analysis

- Overview

- Coronary Heart Disease

- Sudden Cardiac Arrest

- Stroke

- Cerebrovascular Heart Disease

- Others

- End-User: Market Size & Analysis

- Overview

- Hospitals

- Ambulatory Surgical Centers

- Cardiac Centers

- Geography: Market Size & Analysis

- Overview

- North America

- Europe

- Asia Pacific

- Rest of the World

- Competitive Landscape

- Competitor Comparison Analysis

- Market Developments

- Mergers and Acquisitions, Legal, Awards, Partnerships

- Product Launches and execution

- Vendor Profiles

- Medtronic, Boston

- Overview

- Financial Overview

- Product Offerings

- Developments

- Business Strategy

- B. Braun Melsungen AG

- Overview

- Financial Overview

- Product Offerings

- Developments

- Business Strategy

- Becton, Dickinson and Company

- Overview

- Financial Overview

- Product Offerings

- Developments

- Business Strategy

- General Electric Company

- Overview

- Financial Overview

- Product Offerings

- Developments

- Business Strategy

- Biosense Webster, Inc (Johnson and Johnson)

- Overview

- Financial Overview

- Product Offerings

- Developments

- Business Strategy

- Scientific Corporation

- Overview

- Financial Overview

- Product Offerings

- Developments

- Business Strategy

- Abbott Laboratories

- Overview

- Financial Overview

- Product Offerings

- Developments

- Business Strategy

- Koninklijke Philips N.V

- Overview

- Financial Overview

- Product Offerings

- Developments

- Business Strategy

- Siemens AG

- Overview

- Financial Overview

- Product Offerings

- Developments

- Business Strategy

- Edwards Lifesciences Corporation

- Overview

- Financial Overview

- Product Offerings

- Developments

- Business Strategy

- Medtronic, Boston

- Analyst Opinion

- Annexure

- Report Scope

- Market Definitions

- Research Methodology

- Data Collation and In-house Estimation

- Market Triangulation

- Forecasting

- Report Assumptions

- Declarations

- Stakeholders

- Abbreviations

TABLE 1. GLOBAL CARDIOVASCULAR DEVICES MARKET VALUE, BY DEVICE, 2021-2027 (USD BILLION)

TABLE 2. GLOBAL CARDIOVASCULAR DEVICES MARKET VALUE FOR DIAGNOSTIC AND MONITORING DEVICES, BY GEOGRAPHY, 2021-2027 (USD BILLION)

TABLE 3. GLOBAL CARDIOVASCULAR DEVICES MARKET VALUE FOR THERAPEUTIC AND SURGICAL DEVICES, BY GEOGRAPHY, 2021-2027 (USD BILLION)

TABLE 4. GLOBAL CARDIOVASCULAR DEVICES MARKET VALUE FOR OTHERS, BY GEOGRAPHY, 2021-2027 (USD BILLION)

TABLE 5. GLOBAL CARDIOVASCULAR DEVICES MARKET VALUE, BY APPLICATION, BY GEOGRAPHY, 2021-2027 (USD BILLION)

TABLE 6. GLOBAL CARDIOVASCULAR DEVICES MARKET VALUE FOR CORONARY HEART DISEASE, BY GEOGRAPHY, 2021-2027 (USD BILLION)

TABLE 7. GLOBAL CARDIOVASCULAR DEVICES MARKET VALUE FOR SUDDEN CARDIAC ARREST, BY GEOGRAPHY, 2021-2027 (USD BILLION)

TABLE 8. GLOBAL CARDIOVASCULAR DEVICES MARKET VALUE FOR STROKE, BY GEOGRAPHY, 2021-2027 (USD BILLION)

TABLE 9. GLOBAL CARDIOVASCULAR DEVICES MARKET VALUE FOR CEREBROVASCULAR HEART DISEASE, BY GEOGRAPHY, 2021-2027 (USD BILLION)

TABLE 10. GLOBAL CARDIOVASCULAR DEVICES MARKET VALUE FOR OTHERS, BY GEOGRAPHY, 2021-2027 (USD BILLION)

TABLE 11. GLOBAL CARDIOVASCULAR DEVICES MARKET VALUE, BY END-USER, 2021-2027 (USD BILLION)

TABLE 12. GLOBAL CARDIOVASCULAR DEVICES MARKET VALUE FOR HOSPITALS, BY GEOGRAPHY, 2021-2027 (USD BILLION)

TABLE 13. GLOBAL CARDIOVASCULAR DEVICES MARKET VALUE FOR AMBULATORY SURGICAL CENTRES, BY GEOGRAPHY, 2021-2027 (USD BILLION)

TABLE 14. GLOBAL CARDIOVASCULAR DEVICES MARKET VALUE FOR CARDIAC CENTERS, BY GEOGRAPHY, 2021-2027 (USD BILLION)

TABLE 15. NORTH AMERICA CARDIOVASCULAR DEVICES MARKET VALUE, BY COUNTRY, 2021-2027 (USD BILLION)

TABLE 16. NORTH AMERICA CARDIOVASCULAR DEVICES MARKET VALUE, BY DEVICE, 2021-2027 (USD BILLION)

TABLE 17. NORTH AMERICA CARDIOVASCULAR DEVICES MARKET VALUE, BY APPLICATION, 2021-2027 (USD BILLION)

TABLE 18. NORTH AMERICA CARDIOVASCULAR DEVICES MARKET VALUE, BY END-USER, 2021-2027 (USD BILLION)

TABLE 19. U.S CARDIOVASCULAR DEVICES MARKET VALUE, BY DEVICE, 2021-2027 (USD BILLION)

TABLE 20. U.S CARDIOVASCULAR DEVICES MARKET VALUE, BY APPLICATION, 2021-2027 (USD BILLION)

TABLE 21. U.S CARDIOVASCULAR DEVICES MARKET VALUE, BY END-USER, 2021-2027 (USD BILLION)

TABLE 22. CANADA CARDIOVASCULAR DEVICES MARKET VALUE, BY DEVICE, 2021-2027 (USD BILLION)

TABLE 23. CANADA CARDIOVASCULAR DEVICES MARKET VALUE, BY APPLICATION, 2021-2027 (USD BILLION)

TABLE 24. CANADA CARDIOVASCULAR DEVICES MARKET VALUE, BY END-USER, 2021-2027 (USD BILLION)

TABLE 25. EUROPE CARDIOVASCULAR DEVICES MARKET VALUE, BY COUNTRY, 2021-2027 (USD BILLION)

TABLE 26. EUROPE CARDIOVASCULAR DEVICES MARKET VALUE, BY DEVICE, 2021-2027 (USD BILLION)

TABLE 27. EUROPE CARDIOVASCULAR DEVICES MARKET VALUE, BY APPLICATION, 2021-2027 (USD BILLION)

TABLE 28. EUROPE CARDIOVASCULAR DEVICES MARKET VALUE, END-USER, 2021-2027 (USD BILLION)

TABLE 29. GERMANY CARDIOVASCULAR DEVICES MARKET VALUE, BY DEVICE, 2021-2027 (USD BILLION)

TABLE 30. GERMANY CARDIOVASCULAR DEVICES MARKET VALUE, BY APPLICATION, 2021-2027 (USD BILLION)

TABLE 31. GERMANY CARDIOVASCULAR DEVICES MARKET VALUE, BY END-USER, 2021-2027 (USD BILLION)

TABLE 32. U.K CARDIOVASCULAR DEVICES MARKET VALUE, BY DEVICE, 2021-2027 (USD BILLION)

TABLE 33. U.K CARDIOVASCULAR DEVICES MARKET VALUE, BY APPLICATION, 2021-2027 (USD BILLION)

TABLE 34. U.K CARDIOVASCULAR DEVICES MARKET VALUE, BY END-USER, 2021-2027 (USD BILLION)

TABLE 35. FRANCE CARDIOVASCULAR DEVICES MARKET VALUE, BY DEVICE, 2021-2027 (USD BILLION)

TABLE 36. FRANCE CARDIOVASCULAR DEVICES MARKET VALUE, BY APPLICATION, 2021-2027 (USD BILLION)

TABLE 37. FRANCE CARDIOVASCULAR DEVICES MARKET VALUE, BY END-USER, 2021-2027 (USD BILLION)

TABLE 38. ITALY CARDIOVASCULAR DEVICES MARKET VALUE, BY DEVICE, 2021-2027 (USD BILLION)

TABLE 39. ITALY CARDIOVASCULAR DEVICES MARKET VALUE, BY APPLICATION, 2021-2027 (USD BILLION)

TABLE 40. ITALY CARDIOVASCULAR DEVICES MARKET VALUE, BY END-USER, 2021-2027 (USD BILLION)

TABLE 41. SPAIN CARDIOVASCULAR DEVICES MARKET VALUE, BY DEVICE, 2021-2027 (USD BILLION)

TABLE 42. SPAIN CARDIOVASCULAR DEVICES MARKET VALUE, BY APPLICATION, 2021-2027 (USD BILLION)

TABLE 43. SPAIN CARDIOVASCULAR DEVICES MARKET VALUE, BY END-USER, 2021-2027 (USD BILLION)

TABLE 44. ROE CARDIOVASCULAR DEVICES MARKET VALUE, BY DEVICE, 2021-2027 (USD BILLION)

TABLE 45. ROE CARDIOVASCULAR DEVICES MARKET VALUE, BY APPLICATION, 2021-2027 (USD BILLION)

TABLE 46. ROE CARDIOVASCULAR DEVICES MARKET VALUE, BY END-USER, 2021-2027 (USD BILLION)

TABLE 47. ASIA PACIFIC CARDIOVASCULAR DEVICES MARKET VALUE, BY COUNTRY, 2021-2027 (USD BILLION)

TABLE 48. ASIA PACIFIC CARDIOVASCULAR DEVICES MARKET VALUE, BY DEVICE, 2021-2027 (USD BILLION)

TABLE 49. ASIA PACIFIC CARDIOVASCULAR DEVICES MARKET VALUE, BY APPLICATION, 2021-2027 (USD BILLION)

TABLE 50. ASIA PACIFIC CARDIOVASCULAR DEVICES MARKET VALUE, BY END-USER, 2021-2027 (USD BILLION)

TABLE 51. CHINA CARDIOVASCULAR DEVICES MARKET VALUE, BY DEVICE, 2021-2027 (USD BILLION)

TABLE 52. CHINA CARDIOVASCULAR DEVICES MARKET VALUE, BY APPLICATION, 2021-2027 (USD BILLION)

TABLE 53. CHINA CARDIOVASCULAR DEVICES MARKET VALUE, BY END-USER, 2021-2027 (USD BILLION)

TABLE 54. INDIA CARDIOVASCULAR DEVICES MARKET VALUE, BY DEVICE, 2021-2027 (USD BILLION)

TABLE 55. INDIA CARDIOVASCULAR DEVICES MARKET VALUE, BY APPLICATION, 2021-2027 (USD BILLION)

TABLE 56. INDIA CARDIOVASCULAR DEVICES MARKET VALUE, BY END-USER, 2021-2027 (USD BILLION)

TABLE 57. JAPAN CARDIOVASCULAR DEVICES MARKET VALUE, BY DEVICE, 2021-2027 (USD BILLION)

TABLE 58. JAPAN CARDIOVASCULAR DEVICES MARKET VALUE, BY APPLICATION, 2021-2027 (USD BILLION)

TABLE 59. JAPAN CARDIOVASCULAR DEVICES MARKET VALUE, BY END-USER, 2021-2027 (USD BILLION)

TABLE 60. REST OF APAC CARDIOVASCULAR DEVICES MARKET VALUE, BY DEVICE, 2021-2027 (USD BILLION)

TABLE 61. REST OF APAC CARDIOVASCULAR DEVICES MARKET VALUE, BY APPLICATION, 2021-2027 (USD BILLION)

TABLE 62. REST OF APAC CARDIOVASCULAR DEVICES MARKET VALUE, BY END-USER, 2021-2027 (USD BILLION)

TABLE 63. REST OF WORLD CARDIOVASCULAR DEVICES MARKET VALUE, BY DEVICE, 2021-2027 (USD BILLION)

TABLE 64. REST OF WORLD CARDIOVASCULAR DEVICES MARKET VALUE, BY APPLICATION, 2021-2027 (USD BILLION)

TABLE 65. REST OF WORLD CARDIOVASCULAR DEVICES MARKET VALUE, BY END-USER, 2021-2027 (USD BILLION)

TABLE 66. MEDTRONIC, BOSTON: FINANCIALS

TABLE 67. MEDTRONIC, BOSTON: PRODUCTS & SERVICES

TABLE 68. MEDTRONIC, BOSTON: RECENT DEVELOPMENTS

TABLE 69. B. BRAUN MELSUNGEN AG: FINANCIALS

TABLE 70. B. BRAUN MELSUNGEN AG: PRODUCTS & SERVICES

TABLE 71. B. BRAUN MELSUNGEN AG: RECENT DEVELOPMENTS

TABLE 72. BECTON, DICKINSON AND COMPANY: FINANCIALS

TABLE 73. BECTON, DICKINSON AND COMPANY: PRODUCTS & SERVICES

TABLE 74. BECTON, DICKINSON AND COMPANY: RECENT DEVELOPMENTS

TABLE 75. GENERAL ELECTRIC COMPANY: FINANCIALS

TABLE 76. GENERAL ELECTRIC COMPANY: PRODUCTS & SERVICES

TABLE 77. GENERAL ELECTRIC COMPANY: RECENT DEVELOPMENTS

TABLE 78. BIOSENSE WEBSTER, INC (JOHNSON AND JOHNSON): FINANCIALS

TABLE 79. BIOSENSE WEBSTER, INC (JOHNSON AND JOHNSON): PRODUCTS & SERVICES

TABLE 80. BIOSENSE WEBSTER, INC (JOHNSON AND JOHNSON): RECENT DEVELOPMENTS

TABLE 81. SCIENTIFIC CORPORATION: FINANCIALS

TABLE 82. SCIENTIFIC CORPORATION: PRODUCTS & SERVICES

TABLE 83. SCIENTIFIC CORPORATION: RECENT DEVELOPMENTS

TABLE 84. ABBOTT LABORATORIES: FINANCIALS

TABLE 85. ABBOTT LABORATORIES: PRODUCTS & SERVICES

TABLE 86. ABBOTT LABORATORIES: RECENT DEVELOPMENTS

TABLE 87. KONINKLIJKE PHILIPS N.V: FINANCIALS

TABLE 88. KONINKLIJKE PHILIPS N.V: PRODUCTS & SERVICES

TABLE 89. KONINKLIJKE PHILIPS N.V: RECENT DEVELOPMENTS

TABLE 90. SIEMENS AG: FINANCIALS

TABLE 91. SIEMENS AG: PRODUCTS & SERVICES

TABLE 92. SIEMENS AG: RECENT DEVELOPMENTS

TABLE 93. EDWARDS LIFESCIENCES CORPORATION: FINANCIALS

TABLE 94. EDWARDS LIFESCIENCES CORPORATION: PRODUCTS & SERVICES

TABLE 95. EDWARDS LIFESCIENCES CORPORATION: RECENT DEVELOPMENTS

Research Framework

Infoholic Research works on a holistic 360° approach in order to deliver high quality, validated and reliable information in our market reports. The Market estimation and forecasting involves following steps:

- Data Collation (Primary & Secondary)

- In-house Estimation (Based on proprietary data bases and Models)

- Market Triangulation

- Forecasting

Market related information is congregated from both primary and secondary sources.

Primary sources

Involved participants from all global stakeholders such as Solution providers, service providers, Industry associations, thought leaders etc. across levels such as CXOs, VPs and managers. Plus, our in-house industry experts having decades of industry experience contribute their consulting and advisory services.

Secondary sources

Include public sources such as regulatory frameworks, government IT spending, government demographic indicators, industry association statistics, and company publications along with paid sources such as Factiva, OneSource, Bloomberg among others.