Aircraft Cabin Management Market By Type (Business Aviation and Commercial Aviation), and By Product (IFE, Passenger Unit, and Flight Attendant Control Panel) - Global Forecast to 2024

- May, 2019

- Domain: ICT - Verticals - Aerospace

- Get Free 10% Customization in this Report

[68 Report Pages] Aircraft cabin management market a subsegment of the aircraft interior market includes the revenue generated from the sale of flight attendant control panel, IFE, and passenger unit. Global aircraft market is witnessing increase in innovation of cabin designing and management, especially for business jets and luxury private jets. While some innovation helps to address passenger issues, some are focused on enhancing the comfort of the passengers. In commercial aviation, the economy class has witnessed fewer innovations compared to business class over the past decade. In economy class the prime focus is being applied on developing seats which makes economy class travel much more comfortable by providing better body posture, sleeping position, and reduced pressure points. Another major area in cabin development which is witnessing growth is the area of wellness solutions. Panasonic Avionics is playing a major role in this area with its NEXT platform. NEXT platform is the inflight entertainment platform of Panasonic. Panasonic’s Wellness solution includes Active Noise Control, Premium Seat Lighting, and Panasonic’s nanoe technology.

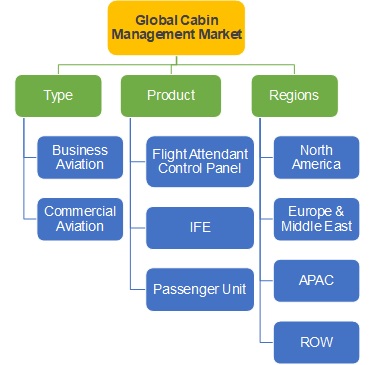

Based on type, aircraft cabin management market is segmented into commercial aviation and business aviation. The revenue generated from commercial aviation was higher in 2018 and is mainly driven by the need for ergonomic seats in the economy class.

Based on product, the market is segmented into passenger unit, in-flight entertainment and flight attendant control panel. Lighting, a part of passenger unit is one of the major revenue generators in the aircraft cabin management market which accounts for the major revenue share.

Based on the geography, the market is split into North America, Europe & Middle East, APAC, and ROW. ROW includes South America and Africa. Middle East is expected to witness a huge growth in business aviation in the forecast period despite the challenges in the region, especially for companies such as Bombardier due to huge demand for business aircrafts from UAE.

Challenges in the airline industry such as increasing fuel cost is affecting the aircraft cabin management market as well. The industry also needs larger labor force for running complex operations leading to a huge payroll expense. Many airlines have closed their operations due to financial difficulties. Any economic fluctuation in the world will affect the spending of airlines, and thereby the aircraft cabin management market. Increasing opportunity for portable inflight connectivity solutions will affect the aircraft cabin management market negatively and eliminates the need for extensive re-wiring and cabin management and retrofitting which leads to a loss of business for aircraft cabin management vendors.

The future of aircraft cabin management will be heavily influenced by IoT and connected technology. IoT will track customer preferences and can make changes in the seating position or food menu based on the customer track record. IFE solutions will be a major influencer behind passenger satisfaction, especially in long-haul flights. Future technological advancements and satellite technologies (like HTS) is expected to increase the internet speed inside flight which could lead to more revenue opportunities for the airlines.

Aircraft cabin management market includes several vendors which includes huge companies within the aerospace industry including Collins Aerospace, Safran, and Airbus and core vendors which focus heavily on providing aircraft cabin solutions like FDS Avionics, STG Aerospace, DPI Labs, BAE Systems, Heads Up, and Astronics. The global vendors are expected to grow further by entering into alliances and strategic partnerships with other players in the market during the forecast period.

According to Infoholic Research, the global aircraft cabin management market will grow at a CAGR of 5.92% during the forecast period 2017–2024. The aim of this report is to define, analyze, and forecast the aircraft cabin management market on the basis of segments, which include type, product, and regions. In addition, the aircraft cabin management market report helps venture capitalists in understanding the companies better and make well-informed decisions and is primarily designed to provide the company’s executives with strategically substantial competitor information, data analysis, and insights about the market, development, and implementation of an effective marketing plan.

Aircraft cabin management is categorized based on three segments – Type, Product, and Regions as shown below:

- The report comprises an analysis of vendor profile, which includes financial status, business units, key business priorities, SWOT, business strategies, and views.

- The report covers the competitive landscape, which includes M&A, joint ventures & collaborations, and competitor comparison analysis.

- In the vendor profile section for companies that are privately held, the financial information and revenue of segments will be limited.

Diehl Aerospace is a joint venture between the German Diehl Group and the French Thales Group. Another major aircraft cabin management provider Safran is based in France. Acquisition of Zodiac Aerospace has helped Safran to enhance their product portfolio in the aircraft cabin management market sphere. The other key players in aircraft cabin management market globally include Collins Aerospace, Airbus, Lufthansa Technik, FDS Avionics, STG Aerospace, BAE Systems, DPI Labs, Heads Up, and Astronics.

1 Executive Summary

2 Industry Outlook

2.1 Industry Snapshot

2.1.1 Industry Trends

3 Market Snapshot

3.1 Total Addressable Market

3.2 Segmented Addressable Market

3.2.1 PEST Analysis

3.2.2 Porter’s Five Force Analysis

3.3 Related Markets

4 Market Characteristics

4.1 Market Evolution

4.1.1 Present

4.1.2 Future

4.2 Market Segmentation

4.3 Market Dynamics

4.3.1 Drivers

4.3.1.1 Growth in use of portable electronic devices

4.3.1.2 Need for weight and cost reduction in aircrafts

4.3.1.3 Growing demand for premium economy class

4.3.2 Restraints

4.3.2.1 Fluctuations in aviation business

4.3.2.2 Challenges while adopting inflight connectivity solutions

4.3.2.3 Growing adoption of portable inflight connectivity solutions

4.3.3 Opportunities

4.3.3.1 Growth of smart cabins

4.3.4 DRO – Impact Analysis

5 Global Aircraft cabin management Market, By Application

5.1 Overview

5.2 Business Aviation

5.3 Commercial Aviation

6 Aircraft Cabin Management Market, By Product

6.1 Overview

6.2 Flight Attendant Control Panel

6.3 In-flight Entertainment

6.4 Passenger Unit

7 Global Aircraft Cabin Management Market, By Geography

7.1 Overview

7.2 North America

7.3 Europe and Middle East

7.3.1 Europe

7.3.2 Middle East

7.4 APAC

7.5 Rest of the World

8 Competitive Landscape

8.1 Competitor Analysis

8.1.1 Mergers & Acquisitions (M&A)

8.1.2 Partnerships

8.2 Market Developments

8.2.1 Business Restructuring

8.2.2 Product Launches & Exhibitions

9 Vendor Profiles

9.1 Diehl Aviation

9.1.1 Overview

9.1.2 Product Profile

9.1.3 Recent Developments

9.1.4 Business Focus

9.1.5 SWOT Analysis

9.2 Safran

9.2.1 Overview

9.2.2 Product Profile

9.2.3 Business Units

9.2.4 Recent Developments

9.2.5 Business Focus

9.2.6 SWOT Analysis

9.3 Collins Aerospace

9.3.1 Overview

9.3.2 Product Profile

9.3.3 Recent Developments

9.3.4 Business Focus

9.3.5 SWOT Analysis

9.4 Airbus

9.4.1 Overview

9.4.2 Product Profile

9.4.3 Business Units

9.4.4 Recent Developments

9.4.5 Business Focus

9.4.6 SWOT Analysis

10 Companies to Watch for

10.1 Lufthansa Technik

10.1.1 Overview

10.1.2 Product Profile

10.1.3 Analyst Opinion

10.2 FDS Avionics

10.2.1 Overview

10.2.2 Product Profile

10.2.3 Analyst Opinion

10.3 STG Aerospace

10.3.1 Overview

10.3.2 Product Profile

10.3.3 Analyst Opinion

10.4 BAE Systems

10.4.1 Overview

10.4.2 Product Profile

10.4.3 Analyst Opinion

10.5 DPI Labs

10.5.1 Overview

10.5.2 Product Profile

10.5.3 Analyst Opinion

10.6 Heads Up

10.6.1 Overview

10.6.2 Product Profile

10.6.3 Analyst Opinion

10.7 Astronics

10.7.1 Overview

10.7.2 Product Profile

10.7.3 Analyst Opinion

11 Annexure

11.1 Report Scope

11.2 Market Definition

11.3 Research Methodology

11.3.1 Data Collation & In-house Estimation

11.3.2 Market Triangulation

11.3.3 Forecasting

11.4 Study Declarations

11.5 Report Assumptions

11.6 Stakeholders

11.7 Abbreviations

TABLE 1 MAJOR AIRLINES AFFECTED BY FINANCIAL CRISIS 19

TABLE 2 GLOBAL AIRCRAFT CABIN MANAGEMENT MARKET VALUE, BY APPLICATION, 2016–2023 ($MILLION) 22

TABLE 3 GLOBAL AIRCRAFT CABIN MANAGEMENT MARKET BY BUSINESS AVIATION, BY GEOGRAPHY, 2017–2024 ($MILLION) 23

TABLE 4 GLOBAL AIRCRAFT CABIN MANAGEMENT MARKET BY COMMERCIAL AVIATION, BY GEOGRAPHY, 2017–2024 ($MILLION) 24

TABLE 5 GLOBAL AIRCRAFT CABIN MANAGEMENT MARKET VALUE, BY PRODUCT, 2017–2024 ($MILLION) 25

TABLE 6 GLOBAL AIRCRAFT CABIN MANAGEMENT MARKET VALUE, BY GEOGRAPHY, 2017–2024 ($MILLION) 30

TABLE 7 AIR TRAFFIC IN NORTH AMERICA 31

TABLE 8 TIMELINE OF COLLINS AEROSPACE 36

TABLE 9 MAJOR MERGERS/ACQUISITIONS IN THE AVIATION INDUSTRY 36

TABLE 10 BUSINESS RESTRUCTURING, 2013–2017 37

TABLE 11 PRODUCT LAUNCHES & EXHIBITIONS, 2013–2019 38

TABLE 12 DIEHL AVIATION: OVERVIEW SNAPSHOT 39

TABLE 13 DIEHL AVIATION: PRODUCT PROFILE 40

TABLE 14 DIEHL AVIATION: RECENT DEVELOPMENTS 40

TABLE 15 DIEHL AVIATION: SWOT ANALYSIS 41

TABLE 16 SAFRAN: OVERVIEW SNAPSHOT 42

TABLE 17 SAFRAN: PRODUCT PROFILE 43

TABLE 18 SAFRAN: BUSINESS UNITS 43

TABLE 19 SAFRAN: RECENT DEVELOPMENTS 44

TABLE 20 SAFRAN: SWOT ANALYSIS 45

TABLE 21 COLLINS AEROSPACE: OVERVIEW SNAPSHOT 45

TABLE 22 COLLINS AEROSPACE: PRODUCT PROFILE 46

TABLE 23 COLLINS AEROSPACE: RECENT DEVELOPMENTS 47

TABLE 24 COLLINS AEROSPACE: SWOT ANALYSIS 47

TABLE 25 AIRBUS: OVERVIEW SNAPSHOT 48

TABLE 26 AIRBUS: PRODUCT PROFILE 49

TABLE 27 AIRBUS: BUSINESS UNITS 49

TABLE 28 AIRBUS: RECENT DEVELOPMENTS 50

TABLE 29 AIRBUS: SWOT ANALYSIS 50

TABLE 30 LUFTHANSA TECHNIK: PRODUCT PROFILE 51

TABLE 31 FDS AVIONICS: PRODUCT PROFILE 52

TABLE 32 STG AEROSPACE: PRODUCT PROFILE 53

TABLE 33 BAE: PRODUCT PROFILE 54

TABLE 34 DPI LABS: PRODUCT PROFILE 55

TABLE 35 HEADS UP : PRODUCT PROFILE 55

TABLE 36 ASTRONICS : PRODUCT PROFILE 56

TABLE 37 RESEARCH METHODOLOGY OF GLOBAL AIRCRAFT CABIN MANAGEMENT MARKET: TRIANGULATION 59

TABLE 38 RESEARCH METHODOLOGY OF GLOBAL AIRCRAFT CABIN MANAGEMENT MARKET: FORECASTING 60

Research Framework

Infoholic Research works on a holistic 360° approach in order to deliver high quality, validated and reliable information in our market reports. The Market estimation and forecasting involves following steps:

- Data Collation (Primary & Secondary)

- In-house Estimation (Based on proprietary data bases and Models)

- Market Triangulation

- Forecasting

Market related information is congregated from both primary and secondary sources.

Primary sources

Involved participants from all global stakeholders such as Solution providers, service providers, Industry associations, thought leaders etc. across levels such as CXOs, VPs and managers. Plus, our in-house industry experts having decades of industry experience contribute their consulting and advisory services.

Secondary sources

Include public sources such as regulatory frameworks, government IT spending, government demographic indicators, industry association statistics, and company publications along with paid sources such as Factiva, OneSource, Bloomberg among others.