Global Oncology Drugs Market Forecast to 2024

- March, 2018

- Domain: Healthcare - Pharmaceuticals

- Get Free 10% Customization in this Report

Oncology Drugs Market Overview:

Oncology drugs or anti-cancer drugs or anti-neoplastic drugs are agents that can be used alone or in combination to control or destroy neoplastic cells. These agents can be either systemic or targeted. In systemic, the drug spreads throughout the body, whereas in targeted, the drug or substance identifies the specific location causing less harm to the growth of neighboring healthy cells. The oncology drugs market, by applications, is segmented into breast cancer, blood cancer, prostate cancer, gastrointestinal cancer, lung cancer, and others. The incidence of cancer is one of the leading causes of death globally due to unhealthy food habits, changing lifestyle, and increasing consumption of tobacco-related products. According to the estimation of the National Cancer Institute, in the US, around 1.6 million new cases of cancer were diagnosed and 595,690 people died due to cancer in 2016. Nearly 60% of new cancer cases are from Africa, Asia, Central and South American countries and almost 70% of cancer deaths are from these regions. The Indian Council for Medical Research estimated around 1.4 million new cancer cases in 2016, which is expected to rise to 1.7 million cases by 2020.

Increased prevalence of cancer, unhealthy lifestyle, and increasing geriatric population are the primary factors driving the market growth. However, the high cost of the drug & development process and side effects of the drug are the factors hampering the market growth. The development of pipeline oncology products and expiry of key patents are providing an opportunity for the manufacturers of cancer drugs.

Market Analysis:

The global oncology drugs market is estimated to witness a CAGR of 7.0% during the forecast period to 2024. The market is analyzed based on three segments: therapeutic modality, applications, and regions.

Regional Analysis:

The regions covered in the report are North America, Europe, Asia Pacific, and Rest of the World (RoW). North America is set to be the leading region for the oncology drugs market growth followed by Europe, Asia Pacific, and Rest of the World.

Therapeutic Modality Analysis:

The global oncology drugs market by therapeutic modality is segmented into chemotherapy, immunotherapy, targeted therapy, and others. Chemotherapy occupied the largest share in 2017, and immunotherapy is expected to grow at a high CAGR in the coming years due to high efficiency, increased preference of targeted immunotherapy from chemotherapy, and fewer side effects.

Applications Analysis:

The global oncology drugs market by applications is segmented into breast cancer, blood cancer, prostate cancer, gastrointestinal cancer, lung cancer, and others. Blood cancer occupied the largest share in 2017, and lung cancer application is expected to be the fastest growing segment during the forecast period due to the high incidence of lung cancer and promising pipeline for NSCLC drugs.

Key Players:

F. Hoffmann-La Roche Ltd., Bristol–Myers Squibb, Novartis AG, Johnson & Johnson, Pfizer, Inc., Celgene Corporation, AstraZeneca PLC, GlaxoSmithKline plc, Eli Lilly and Company, Amgen Inc., Merck & Co., AbbVie, Inc., Sanofi, and other predominate & niche players.

Competitive Analysis:

The high adoption of personalized medicine and immuno-oncology have fueled a shift in cancer treatment from chemotherapy in the past decade. During 2011–2017, around 84 new drugs have been approved across 22 indications globally, of which immuno-oncology PD-1 and PD-L1 inhibitors have seen a speedy uptake based on their notable clinical profile and approval for various cancers. Additionally, there is a robust late-stage oncology pipeline with around 630 unique molecules in the development, i.e., more than 7% when compared to the previous year, including 278 biological therapies and 82 vaccines. The market is dominated by key vendors such as F. Hoffmann-La Roche Ltd., Bristol–Myers Squibb, Novartis AG, Celgene Corporation, Pfizer Inc., and Johnson & Johnson; and products of these firms are available globally through their distributors and subsidiaries.

Benefits:

The report provides complete details about the usage and adoption of oncology drugs in various applications and regions. With that, key stakeholders can know about the major trends, drivers, investments, vertical player’s initiatives, government initiatives toward the product adoption in the upcoming years along with the details of commercial products available in the market. Moreover, the report provides details about the major challenges that are going to impact on the market growth. Additionally, the report gives the complete details about the key business opportunities to key stakeholders to expand their business and capture the revenue in specific verticals to analyze before investing or expanding the business in this market.

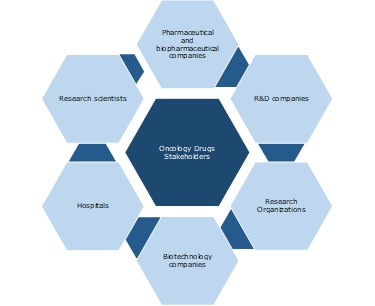

Key Stakeholders:

1 INDUSTRY OUTLOOK

1.1 Industry overview

1.2 Industry Trends

1.3 Total addressable market

1.4 Trends of cancer therapy market

2 Report Outline

2.1 Report Scope

2.2 Report Summary

2.3 Research Methodology

2.4 Report Assumptions

3 Market Snapshot

3.1 Market Definition – Infoholic Research

3.2 Segmented Addressable Market (SAM)

3.3 Trends of the oncology drugs market

3.4 Related Markets

3.4.1 Over the counter drugs (OTC)

3.4.2 Active pharmaceutical ingredients (APIs)

3.4.3 Diabetes Drugs

4 Market Outlook

4.1 Oncology Drugs Approved by FDA (2014 – 2018)

4.2 Market segmentation

4.3 PEST Analysis

4.4 Porter 5(Five) Forces

5 Market Characteristics

5.1 DRO – Global Oncology Drugs Market Dynamics

5.1.1 Drivers

5.1.1.1 Increasing incidence of cancer across the globe

5.1.1.2 Growing geriatric population

5.1.1.3 Expiration of patents

5.1.2 Opportunities

5.1.2.1 Growing focus on personalized medicine

5.1.2.2 Increasing healthcare spending

5.1.3 Restraints

5.1.3.1 High cost of the drug

5.1.3.2 Side effects of oncology drugs

6 Therapeutic modality: Market Size and Analysis

6.1 Overview

6.2 Chemotherapy

6.3 Targeted therapy

6.4 Immunotherapy

6.5 Others

7 Application: Market Size and Analysis

7.1 Overview

7.2 Blood cancer

7.3 Breast cancer

7.4 Gastro intestinal cancer

7.5 Lung cancer

7.6 Prostate cancer

7.7 Others

8 Regions: Market Size and Analysis

8.1 Overview

8.2 North America

8.2.1 Overview

8.2.2 US

8.2.3 Canada

8.3 Europe

8.3.1 Overview

8.3.2 UK

8.3.3 Germany

8.3.4 France

8.3.5 Italy

8.4 APAC

8.4.1 Overview

8.4.2 India

8.4.3 China

8.5 Rest of the World

9 Competitive Landscape

9.1 Overview

10 Vendor Profiles

10.1 F.Hoffmann-La Roche Ltd

10.1.1 Overview

10.1.2 Business Unit

10.1.3 Geographic Presence

10.1.4 Business Focus

10.1.5 SWOT Analysis

10.1.6 Business Strategy

10.2 Novartis AG

10.2.1 Overview

10.2.2 Business Unit

10.2.3 Geographic Presence

10.2.4 Business Focus

10.2.5 SWOT Analysis

10.2.6 Business Strategy

10.3 Bristol-Myers Squibb

10.3.1 Overview

10.3.2 Geographic Presence

10.3.3 Business Focus

10.3.4 SWOT Analysis

10.3.5 Business Strategy

10.4 Celgene Corporation

10.4.1 Overview

10.4.2 Geographic Presence

10.4.3 Business Focus

10.4.4 SWOT Analysis

10.4.5 Business Strategy

10.5 Johnson & Johnson

10.5.1 Overview

10.5.2 Business Units

10.5.3 Geographic Revenue

10.5.4 Business Focus

10.5.5 SWOT Analysis

10.5.6 Business Strategies

10.6 Pfizer Inc.,

10.6.1 Overview

10.6.2 Geographic Presence

10.6.3 Business Focus

10.6.4 SWOT Analysis

10.6.5 Business Strategies

11 Companies to Watch For

11.1 Astra Zenca PLC

11.1.1 Overview

11.2 Eli Lilly and Company.

11.2.1 Overview

11.3 GlaxoSmithKline plc

11.3.1 Overview

11.4 Merck & Co.

11.4.1 Overview

11.5 Sanofi

11.5.1 Overview

11.6 Amgen Inc.

11.6.1 Overview

11.7 AbbVie, Inc.

11.7.1 Overview

12 Annexure

12.1 Abbreviations

Research Framework

Infoholic research works on a holistic 360° approach in order to deliver high quality, validated and reliable information in our market reports. The Market estimation and forecasting involves following steps:

- Data Collation (Primary & Secondary)

- In-house Estimation (Based on proprietary data bases and Models)

- Market Triangulation

- Forecasting

Market related information is congregated from both primary and secondary sources.

Primary sources

involved participants from all global stakeholders such as Solution providers, service providers, Industry associations, thought leaders etc. across levels such as CXOs, VPs and managers. Plus, our in-house industry experts having decades of industry experience contribute their consulting and advisory services.

Secondary sources

include public sources such as regulatory frameworks, government IT spending, government demographic indicators, industry association statistics, and company publications along with paid sources such as Factiva, OneSource, Bloomberg among others.