Contract Research Organization Services (CROs) Market By Product Type (Early-phase development service, Clinic research services, Laboratory services, Consulting service), By End User (Pharmaceutical and Biopharmaceutical Companies, Medical Device Companies, Academic Institutes), By Geography – Global Drivers, Restraints, Opportunities, Trends, and Forecast up to 2026

- September, 2020

- Domain: Healthcare - Pharmaceuticals

- Get Free 10% Customization in this Report

A Contract Research Organisation is an organization hired by laboratory/drug discovery & development organizations company to manage and lead the company's research trials, duties, and functions. Globally most of the biotechnology, medical device, and pharmaceutical companies outsource their drug discovery and drug development process to contract research organizations on a contract basis. Various companies, like Covance, Parexel, and IQVIA, among others, are involved in CRO services. Currently, IQVIA has covered the largest share of CRO in the world market that focuses on digital health and artificial intelligence. In addition to that, over the past few years, the contract research organization market has started booming due to their increased focus towards secured services.

Research Methodology:

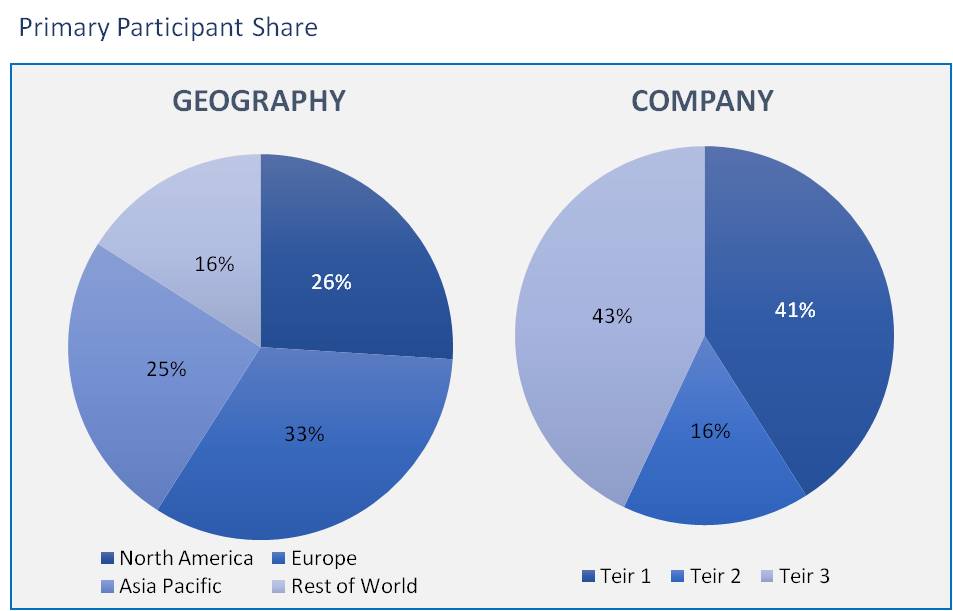

The contract research organization market has been analyzed by utilizing the optimum combination of secondary sources and in-house methodology, along with an irreplaceable blend of primary insights. The real-time assessment of the market is an integral part of our market sizing and forecasting methodology. Our industry experts and panel of primary participants have helped in compiling relevant aspects with realistic parametric estimations for a comprehensive study. The participation share of different categories of primary participants is given below:

The rise in R&D programs and investments increases the demand for contract research organizations' services, which help with time & cost constraints, and patent expiration in the healthcare sector. Contract research outsourcing collaborations offer cutting-edge services that attract government organizations to assign their projects to contract research organizations (CROs), thereby facilitating global market demand.

The scope of the Contract Research Organization Services (CROs) Market is defined in the market analysis as follows:

- Product Type: Market Size & Analysis

-

- Early phase development service

-

- Discovery Studies

- Chemistry, Manufacturing & Control

- Preclinical Services

- Pharmacokinetics/ pharmacodynamics (PK/PD)

- Toxicology testing

- Others

-

- Clinic research services

-

- Phase I

- Phase II

- Phase III

- Phase IV

-

- Laboratory services

-

- Bioanalytical testing

- Analytical testing

-

- Physical characterization

- Stability testing

- Batch release testing

- Raw material testing

- Others

- Consulting service

The Contract Research Organization Services (CROs) Market by product covers the Early phase development service, Clinic research services, Laboratory Services, and Consulting service. Among all types, clinical research dominates the global market due to an increase in the geriatric population and the subsequent increase in the prevalence of chronic diseases. This subsequently increased the need to develop new drugs and the growing acceptance of evidence-based medicine for various therapeutic areas.

- Based on End-User

- Pharmaceutical and Biopharmaceutical Companies

- Medical Device Companies

- Academic Institutes

Based on the end-user, the market is segmented into pharmaceutical & biopharmaceutical companies, medical device companies, and academic institutes & government. In the global contract research organization services market, the Pharmaceutical and Biopharmaceutical Companies segment accounted for the largest share due to the increasing preferences for outsources services to increase to avoid expensive capital expenditure and improve the overall business performance.

- Based on Geography:

- North America

- Europe

- Asia Pacific

- Rest of the World

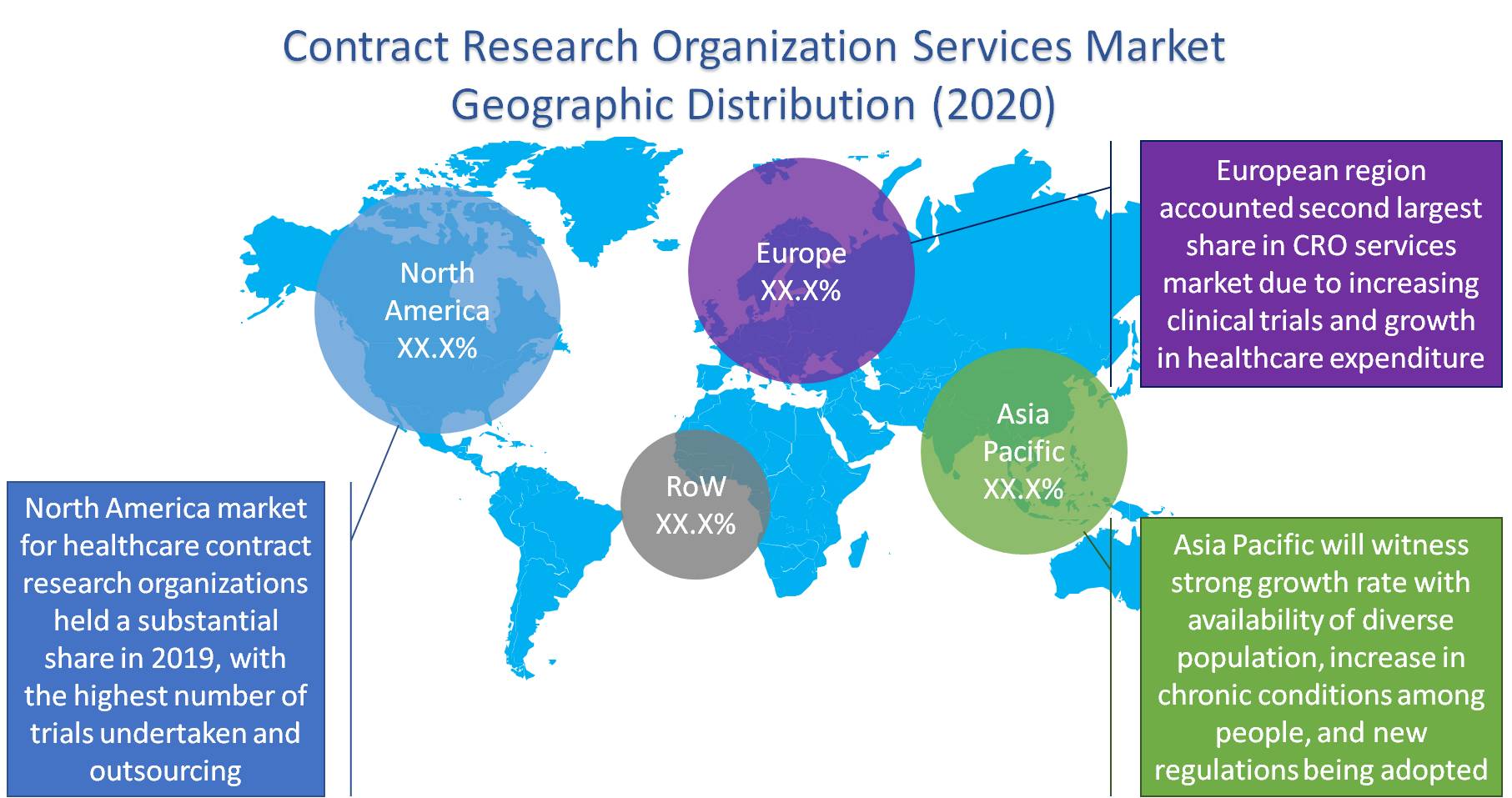

The Contract Research Organization Services market is majorly segmented into four regions, which are North America, Europe, Asia Pacific, and Rest of the World. Among these regions, the North America region accounted for the largest share in the contract research organization services market due to the increasing number of drug development trials and outsourced services in this region. Besides, growing government support through grants and funds for R&D activities to research institutes and companies has driven this regional market.

Asia Pacific witnessed the highest CAGR in the healthcare CRO market in 2019 due to the availability of diverse population, increase in chronic conditions among people, and establishment of regulations as per ace pted standards. In India, the Central Drug Standard Control Organization (CDSCO), in coordination with the local authorities, regulates clinical trials. Recently the CDSCO introduced new rules to reduced drug approval duration, which increase the demand for CRO services.

The global market for Contract Research Organization (CRO) services is projected to reach USD 58.55 billion by 2026 from USD 38.96 billion in 2020, at a CAGR of 6.8% during the forecast period. The factors driving this market are cost-effective service and accessible software to everyone in the business for providing valuable solutions for the enterprise.

The report also includes the analysis of major players in the Contract Research Organization Services (CROs) market. Some of the major players consist of IQVIA, ICON Plc., Charles River Laboratories, Syneos Health Inc, PRA Health Sciences, PPD, Parexel International, WuXi Apptec, and. LabCorp,

This report will help the market players to understand the market trends, recent developments, market dynamics, and end-user demand. The comprehensive analysis includes the qualitative and quantitative factors of the market.

- The competitive analysis of the major players in the market gives the freedom to the users to understand the dynamic strategies such as product innovation, partnerships, mergers & acquisitions, and joint ventures of the key players.

- This report also provides the insights of leading players in various types of analysis like SWOT analysis, portfolio analysis, capability analysis of the leading players.

- The quantitative and exhaustive analysis of the market enables users to understand the facts of the market across four major regions.

1. Executive Summary

2. Industry Outlook

2.1. Industry Overview

2.2. Industry Trends

3. Market Snapshot

3.1. Market Definition

3.2. Market Outlook

3.3. PEST Analysis

3.4. Porter Five Forces

3.5. Related Markets

4. Market characteristics

4.1. Market Evolution

4.2. Market Trends and Impact

4.3. Advantages/Disadvantages of Market

4.4. Regulatory Impact

4.5. Market Offerings

4.6. Market Segmentation

4.7. Market Dynamics

4.7.1. Drivers

4.7.2. Restraints

4.7.3. Opportunities

4.8. DRO - Impact Analysis

5. End-User: Market Size & Analysis

5.1. Overview

5.2. Pharmaceutical and Biopharmaceutical Companies

5.3. Medical Device Companies

5.4. Academic Institutes

6. Type: Market Size & Analysis

6.1. Overview

6.2. Early phase development service

6.2.1. Discovery Studies

6.2.2. Chemistry, Manufacturing & Control

6.2.3. Preclinical Services

6.2.3.1. Pharmacokinetics/ pharmacodynamics (PK/PD)

6.2.3.2. Toxicology testing

6.2.3.3. Others

6.3. Clinic research services

6.3.1. Phase I

6.3.2. Phase II

6.3.3. Phase III

6.3.4. Phase IV

6.4. Laboratory services

6.4.1. Bioanalytical testing

6.4.2. Analytical testing

6.4.2.1. Physical characterization

6.4.2.2. Stability testing

6.4.2.3. Batch release testing

6.4.2.4. Raw material testing

6.4.2.5. Others

6.5. Consulting service

7. Geography: Market Size & Analysis

7.1. Overview

7.2. North America

7.3. Europe

7.4. Asia Pacific

7.5. Rest of the World

8. Competitive Landscape

8.1. Competitor Comparison Analysis

8.2. Market Developments

8.3. Mergers and Acquisitions, Legal, Awards, Partnerships

8.4. Product Launches and execution

9. Vendor Profiles

9.1. IQVIA

9.1.1. Overview

9.1.2. Product Offerings

9.1.3. Geographic Revenue

9.1.4. Business Units

9.1.5. Developments

9.1.6. Business Strategy

9.2. LabCorp

9.2.1. Overview

9.2.2. Product Offerings

9.2.3. Geographic Revenue

9.2.4. Business Units

9.2.5. Developments

9.2.6. Business Strategy

9.3. Charles river Laboratories

9.3.1. Overview

9.3.2. Product Offerings

9.3.3. Geographic Revenue

9.3.4. Business Units

9.3.5. Developments

9.3.6. Business Strategy

9.4. WuXi Apptec

9.4.1. Overview

9.4.2. Product Offerings

9.4.3. Geographic Revenue

9.4.4. Business Units

9.4.5. Developments

9.4.6. Business Strategy

9.5. Syneos Health Inc

9.5.1. Overview

9.5.2. Product Offerings

9.5.3. Geographic Revenue

9.5.4. Business Units

9.5.5. Developments

9.5.6. Business Strategy

9.6. Paraxel International

9.6.1. Overview

9.6.2. Product Offerings

9.6.3. Geographic Revenue

9.6.4. Business Units

9.6.5. Developments

9.6.6. Business Strategy

9.7. PRA Health Sciences

9.7.1. Overview

9.7.2. Product Offerings

9.7.3. Geographic Revenue

9.7.4. Business Units

9.7.5. Developments

9.7.6. Business Strategy

9.8. PPD

9.8.1. Overview

9.8.2. Product Offerings

9.8.3. Geographic Revenue

9.8.4. Business Units

9.8.5. Developments

9.8.6. Business Strategy

9.9. ICON Plc

9.9.1. Overview

9.9.2. Product Offerings

9.9.3. Geographic Revenue

9.9.4. Business Units

9.9.5. Developments

9.9.6. Business Strategy

10. Companies to Watch

10.1. SGS

10.1.1. Overview

10.1.2. Market

10.1.3. Business Strategy

10.2. PSI CRO AG

10.2.1. Overview

10.2.2. Market

10.2.3. Business Strategy

10.3. Axcent Advanced Analytics

10.3.1. Overview

10.3.2. Market

10.3.3. Business Strategy

10.4. BIO Agile Therapeutics

10.4.1. Overview

10.4.2. Market

10.4.3. Business Strategy

10.5. Firma Clinical Research

10.5.1. Overview

10.5.2. Market

10.5.3. Business Strategy

10.6. ACCULAB LIFESCIENCES

10.6.1. Overview

10.6.2. Market

10.6.3. Business Strategy

10.7. Azelix

10.7.1. Overview

10.7.2. Market

10.7.3. Business Strategy

10.8. CTSERV

10.8.1. Overview

10.8.2. Market

10.8.3. Business Strategy

10.9. PEPGRA

10.9.1. Overview

10.9.2. Market

10.9.3. Business Strategy

10.10. DOVE QUALITY SOLUTIONS

10.10.1. Overview

10.10.2. Market

10.10.3. Business Strategy

11. Analyst Opinion

12. Annexure

12.1. Report Scope

12.2. Market Definitions

12.3. Research Methodology

12.3.1. Data Collation and In-house Estimation

12.3.2. Market Triangulation

12.3.3. Forecasting

12.4. Report Assumptions

12.5. Declarations

12.6. Stakeholders

12.7. Abbreviations

Research Framework

Infoholic research works on a holistic 360° approach in order to deliver high quality, validated and reliable information in our market reports. The Market estimation and forecasting involves following steps:

- Data Collation (Primary & Secondary)

- In-house Estimation (Based on proprietary data bases and Models)

- Market Triangulation

- Forecasting

Market related information is congregated from both primary and secondary sources.

Primary sources

involved participants from all global stakeholders such as Solution providers, service providers, Industry associations, thought leaders etc. across levels such as CXOs, VPs and managers. Plus, our in-house industry experts having decades of industry experience contribute their consulting and advisory services.

Secondary sources

include public sources such as regulatory frameworks, government IT spending, government demographic indicators, industry association statistics, and company publications along with paid sources such as Factiva, OneSource, Bloomberg among others.