Biosimilars Market by Product (Insulin, rhGH, Granulocyte colony-stimulating factor, Interferon, Erythropoietin, Etanercept, Monoclonal antibodies, Follitropin, Glucagon, Calcitonin, Teriparatide, and Enoxaparin Sodium), By Manufacturing (In-house, Contract) & Indication (Offsite Treatment, Oncology, Chronic Disease, Blood Disorder, Autoimmune Disease, Blood Disorders, Infectious Disease, and Other Diseases), By Geography (North America, Europe, APAC, and RoW) - Global Opportunity Analysis and Industry Forecast up to 2026

- July, 2020

- Domain: Healthcare - Pharmaceuticals

- Get Free 10% Customization in this Report

Biosimilars or follow-on-biologics are the "duplicated" and authorized variants of those reference biologics that have experienced patent expiration. Biosimilars improvement and approval with reference biologics is a significant part of the general advancement and development process. Guidelines for biosimilars assume an essential job in keeping up the suitability and harmony among unique and biosimilars items. Different regulatory specialists, for example, EMA and FDA effectively control Biosimilars commercialization and advancement.

Research Methodology:

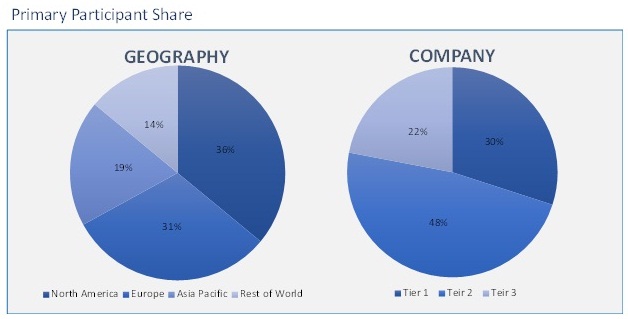

The biosimilars market has been analyzed by utilizing the optimum combination of secondary sources and in-house methodology, along with an irreplaceable blend of primary insights. The real-time assessment of the market is an integral part of our market sizing and forecasting methodology. Our industry experts and panel of primary participants have helped in compiling relevant aspects with realistic parametric estimations for a comprehensive study. The participation share of different categories of primary participants is given below:

The market is driven by factors such as the rising prevalence of chronic diseases such as cancer and diabetes supplement the growing demands of pharmaceutical drugs. However, market growth is limited by manufacturing complexities and resistance from biological manufacturers. Furthermore, the growth of the biosimilars market is hampered with multiple factors including the lack of regulatory guidelines, consumers’ brand preferences, the reluctance of physicians to prescribed biosimilars, and the high capital required for research and development.

Based on the parameter of manufacturing, the market of Biosimilars is segmented into two segments:

- In-house manufacturing

- Contract manufacturing

The in-house manufacturing segment makes up for the larger market share, while the contract manufacturing segment is expected to witness the highest CAGR during the forecasting period.

Based on the product, the biosimilars market monoclonal antibody industry is prominently segmented into trastuzumab, infliximab, rituximab, adalimumab, and other monoclonal antibodies. The infliximab segment accounted for the largest biosimilars market share in 2019. The growing prevalence of autoimmune diseases drives market growth.

Based on the indication, the market is segregated on the basis of:

- Oncology

- Blood Disorder

- Offsite Treatment

- Infectious Diseases

- Chronic Diseases

- Autoimmune Disease

- Other Diseases

The oncology segment accounts for a major share of the biosimilars market. The large share of this segment can be attributed to the high incidence of cancer across the globe.

Some of the major players in the domain of Biosimilars are Probiomed, Boehringer Ingelheim, Apotex, Fresenius Kabi, Gedeon Richter, Mabxience, Amega Biotech, Biocad, Coherus Biosciences, Stada Arzneimittel Ag, Dr. Reddy’s Laboratories, Mylan, Samsung Biologics, Amgen, Biocon, Celltrion, Teva Pharmaceutical, Eli Lilly, Pfizer, and Sandoz.

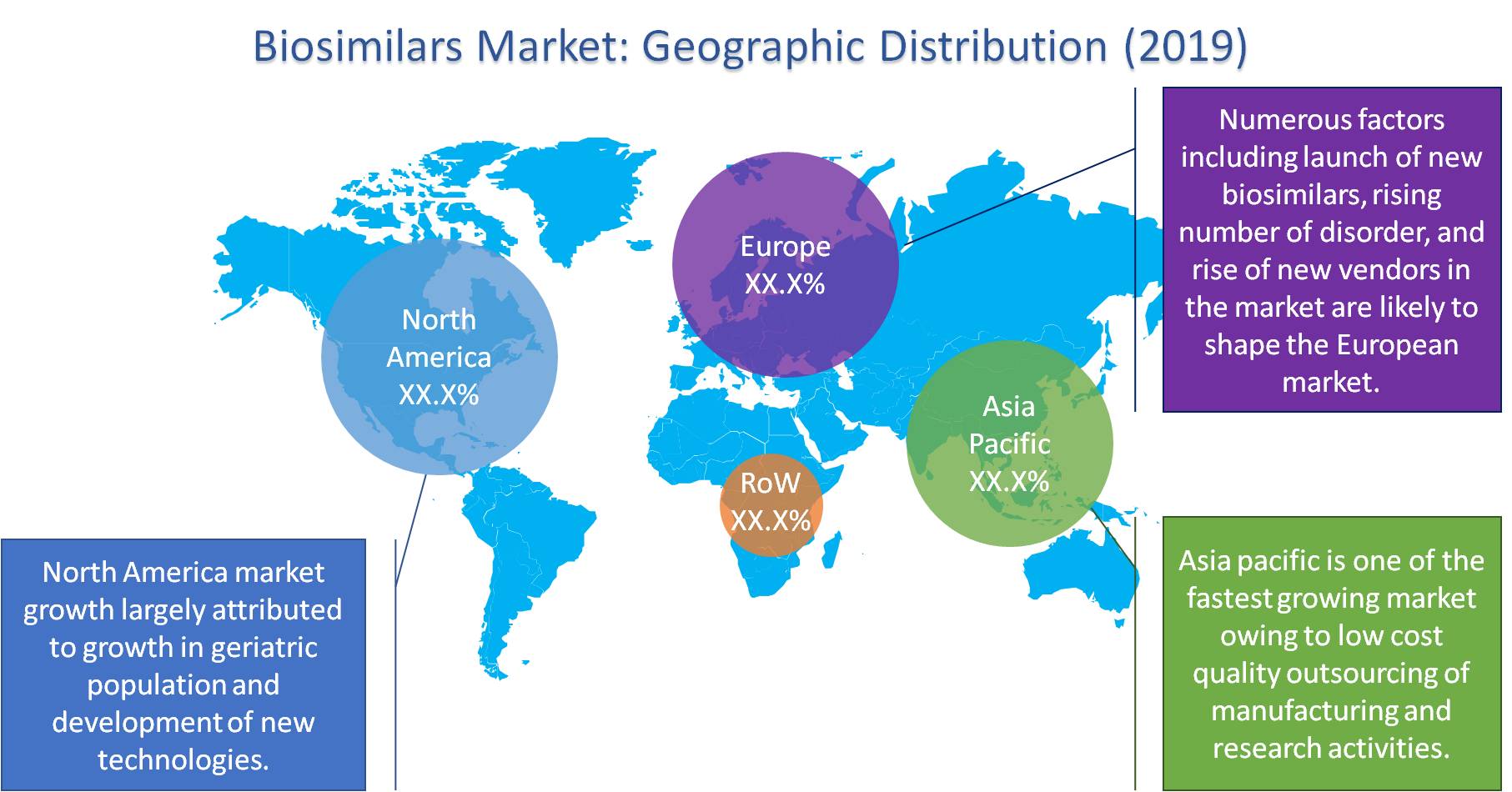

By Geography, the market of Biosimilars is further classified into North America, Europe, the Asia Pacific, and the rest of the World. North America accounted for the largest share. There are two important factors which are the driving forces behind the growth of Biosimilars market giving it CAGR of 23.9% during the forecast period. These two factors are:

- Lower pricing than competing biologics

- Rising incidence of chronic diseases

There are a lot of opportunities in emerging countries and this report will help in understanding the current market dynamics, changing needs, and innovations that might be needed to make the user experience enriching.

- This report would be the foundation for any research on the Biosimilars, vendor capabilities, SWOT of the sensors, and organized framework for data analysis for further advanced innovation.

- This piece of the report would be the backbone for exhaustive research and a tool for the upcoming innovations and technologies. This gives an idea about the major competitors in the market, their journey, and the competitive edge which one should have to beat other players in the market.

- The report is having a qualitative analysis of the Biosimilars market and the opportunity which can be leveraged by the market in the current scenario

- The market report would be delving into deep insights regarding the technological innovations

1. Executive Summary

2. Industry Outlook

2.1. Industry Overview

2.2. Industry Trends

3. Market Snapshot

3.1. Market Definition

3.2. Market Outlook

3.3. PEST Analysis

3.4. Porter Five Forces

3.5. Related Markets

4. Market characteristics

4.1. Market Evolution

4.2. Market Trends and Impact

4.3. Advantages/Disadvantages of Market

4.4. Regulatory Impact

4.5. Market Offerings

4.6. Market Segmentation

4.7. Market Dynamics

4.7.1. Drivers

4.7.2. Restraints

4.7.3. Opportunities

4.8. DRO - Impact Analysis

5. Indication: Market Size & Analysis

5.1. Overview

5.2. Autoimmune Disease

5.3. Blood Disorders

5.4. Infectious Disease

5.5. Chronic Disorder

5.6. Oncology

5.7. Offsite Treatment

5.8. Other Diseases

6. Type of Manufacturing: Market Size & Analysis

6.1. Overview

6.2. In-House Manufacturing

6.3. Contract Manufacturing

7. Product: Market Size & Analysis

7.1. Overview

7.2. Insulin

7.3. Recombinant human growth hormone (rhGH)

7.4. Granulocyte colony-stimulating factor

7.5. Interferon

7.6. Erythropoietin

7.7. Etanercept

7.8. Monoclonal antibodies

7.8.1. Rituximab

7.8.2. Infliximab

7.8.3. Adalimumab

7.8.4. Trastuzumab

7.9. Follitropin

7.10. Glucagon

7.11. Calcitonin

7.12. Teriparatide

7.13. Enoxaparin Sodium

8. Geography: Market Size & Analysis

8.1. Overview

8.2. North America

8.3. Europe

8.4. Asia Pacific

8.5. Rest of the World

9. Competitive Landscape

9.1. Competitor Comparison Analysis

9.2. Market Developments

9.3. Mergers and Acquisitions, Legal, Awards, Partnerships

9.4. Product Launches and execution

10. Vendor Profiles

10.1. Dr. Reddy’s Laboratories

10.1.1. Overview

10.1.2. Product Offerings

10.1.3. Geographic Revenue

10.1.4. Business Units

10.1.5. Developments

10.1.6. SWOT Analysis

10.1.7. Business Strategy

10.2. Stada Arzneimittel Ag

10.2.1. Overview

10.2.2. Product Offerings

10.2.3. Geographic Revenue

10.2.4. Business Units

10.2.5. Developments

10.2.6. SWOT Analysis

10.2.7. Business Strategy

10.3. Coherus Biosciences

10.3.1. Overview

10.3.2. Product Offerings

10.3.3. Geographic Revenue

10.3.4. Business Units

10.3.5. Developments

10.3.6. SWOT Analysis

10.3.7. Business Strategy

10.4. Biocad

10.4.1. Overview

10.4.2. Product Offerings

10.4.3. Geographic Revenue

10.4.4. Business Units

10.4.5. Developments

10.4.6. SWOT Analysis

10.4.7. Business Strategy

10.5. Amega Biotech

10.5.1. Overview

10.5.2. Product Offerings

10.5.3. Geographic Revenue

10.5.4. Business Units

10.5.5. Developments

10.5.6. SWOT Analysis

10.5.7. Business Strategy

10.6. Probiomed

10.6.1. Overview

10.6.2. Product Offerings

10.6.3. Geographic Revenue

10.6.4. Business Units

10.6.5. Developments

10.6.6. SWOT Analysis

10.6.7. Business Strategy

10.7. Boehringer Ingelheim

10.7.1. Overview

10.7.2. Product Offerings

10.7.3. Geographic Revenue

10.7.4. Business Units

10.7.5. Developments

10.7.6. SWOT Analysis

10.7.7. Business Strategy

10.8. Apotex

10.8.1. Overview

10.8.2. Product Offerings

10.8.3. Geographic Revenue

10.8.4. Business Units

10.8.5. Developments

10.8.6. SWOT Analysis

10.8.7. Business Strategy

10.9. Fresenius Kabi

10.9.1. Overview

10.9.2. Product Offerings

10.9.3. Geographic Revenue

10.9.4. Business Units

10.9.5. Developments

10.9.6. SWOT Analysis

10.9.7. Business Strategy

10.10. Gedeon Richter

10.10.1. Overview

10.10.2. Product Offerings

10.10.3. Geographic Revenue

10.10.4. Business Units

10.10.5. Developments

10.10.6. SWOT Analysis

10.10.7. Business Strategy

11. Companies to Watch

11.1. Mabxience

11.1.1. Overview

11.1.2. Market

11.1.3. Business Strategy

11.2. Sandoz

11.2.1. Overview

11.2.2. Market

11.2.3. Business Strategy

11.3. Pfizer

11.3.1. Overview

11.3.2. Market

11.3.3. Business Strategy

11.4. Eli Lilly

11.4.1. Overview

11.4.2. Market

11.4.3. Business Strategy

11.5. Teva Pharmaceutical

11.5.1. Overview

11.5.2. Market

11.5.3. Business Strategy

11.6. Celltrion

11.6.1. Overview

11.6.2. Market

11.6.3. Business Strategy

11.7. Biocon

11.7.1. Overview

11.7.2. Market

11.7.3. Business Strategy

11.8. Amgen

11.8.1. Overview

11.8.2. Market

11.8.3. Business Strategy

11.9. Samsung Biologics

11.9.1. Overview

11.9.2. Market

11.9.3. Business Strategy

11.10. Mylan

11.10.1. Overview

11.10.2. Market

11.10.3. Business Strategy

12. Analyst Opinion

13. Annexure

13.1. Report Scope

13.2. Market Definitions

13.3. Research Methodology

13.3.1. Data Collation and In-house Estimation

13.3.2. Market Triangulation

13.3.3. Forecasting

13.4. Report Assumptions

13.5. Declarations

13.6. Stakeholders

13.7. Abbreviations

Research Framework

Infoholic research works on a holistic 360° approach in order to deliver high quality, validated and reliable information in our market reports. The Market estimation and forecasting involves following steps:

- Data Collation (Primary & Secondary)

- In-house Estimation (Based on proprietary data bases and Models)

- Market Triangulation

- Forecasting

Market related information is congregated from both primary and secondary sources.

Primary sources

involved participants from all global stakeholders such as Solution providers, service providers, Industry associations, thought leaders etc. across levels such as CXOs, VPs and managers. Plus, our in-house industry experts having decades of industry experience contribute their consulting and advisory services.

Secondary sources

include public sources such as regulatory frameworks, government IT spending, government demographic indicators, industry association statistics, and company publications along with paid sources such as Factiva, OneSource, Bloomberg among others.