Global Companion Diagnostics Market 2018-2024

- February, 2018

- Domain: Healthcare - Diagnostics

- Get Free 10% Customization in this Report

Overview: Companion diagnostics are molecular tests that provide essential information for the safety and effective use of the corresponding drug. These tests assist healthcare professionals to decide whether a specific treatment product benefits patient for curing disease, predict drug toxicities, off-target effects of treatment, and other adverse effects related to the drug. It is also used during clinical trials to guide treatment, which can improve therapy responses and treatment outcomes. Currently, there are over 20 approved or cleared companion diagnostic tests and most of the tests are for cancer treatments targeting mutation. According to the estimation of National Cancer Institute, in the US, around 1.6 million new cases of cancer were diagnosed and 595,690 people have died due to cancer in 2016. According to the Canadian Cancer Society, 202,400 new cases of cancer and nearly 78,000 deaths were recorded in 2016. While in Europe, 1.3 million people were diagnosed in 2015. Further, according to the study of World Health Organization, approximately 14 million new cancer cases were diagnosed and is expected to grow by about 70% over the next 2 decades. The trend of increasing incidence of cancer & infectious diseases is catching up even in developing countries due to increased adoption of the Western lifestyle, which is expected to fuel the growth of the companion diagnostics market in coming years.

The companion diagnostics market is booming due to increasing patient base for infectious diseases & cancer globally, high adoption of companion diagnostics, growing demand for companion diagnostics, and emerging applications of companion diagnostics. Low awareness & lack of professionals to conduct tests and unfavorable reimbursement scenario in developed & developing countries are few of the factors hampering the market growth to an extent.

Market Analysis: The “Global Companion Diagnostics” market is estimated to witness a CAGR of 17.6% during the forecast period 2018–2024. The market is analyzed based on four segments – technology, applications, end-users, and regions.

Regional Analysis: The regions covered in the report are North America, Europe, Asia Pacific, and Rest of the World (RoW). North America is set to be the leading region for the companion diagnostics market growth followed by Europe, Asia Pacific, and Rest of the World.

Technology Analysis: The global companion diagnostics market, by technology, is segmented into polymerase chain reaction, immunohistochemistry, in-situ hybridization, next-generation sequencing, and others. Polymerase chain reaction occupied the largest share in 2017, and next-generation sequencing is expected to grow at a high CAGR in the coming years.

Application Analysis: The global companion diagnostics market, by application, is segmented into cancer, infectious disease, and others. The cancer application is further segmented into colorectal cancer, breast cancer, lung cancer, melanoma, and others. In 2017, cancer application occupied a significant market share and is expected to be the same during the forecast period due to increasing incidence of cancer, changing lifestyle, and growing business of preservatives.

For instance, in February 2017, Roche announced the launch of Elecsys AMH Plus immunoassay, the first companion diagnostic to be approved for use in fertility. The key market players are receiving product approvals that are helping them to increase the market share. For instance, in June 2017, the US FDA granted approval to Thermo Fisher Scientific for NGS-based test known as the Oncomine Dx Target test, which instantaneously evaluates 23 genes clinically related to NSCLC.

Benefits: The report provides complete details about the usage and adoption rate of companion diagnostics products in various regions. With that, key stakeholders can know about the major trends, drivers, investments, vertical player’s initiatives, government initiatives toward the test adoption in the upcoming years along with the details of commercial tests available in the market. Moreover, the report provides details about the major challenges that are going to impact on the market growth. Additionally, the report gives the complete details about the key business opportunities to key stakeholders to expand their business and capture the revenue in the specific verticals to analyze before investing or expanding the business in this market.

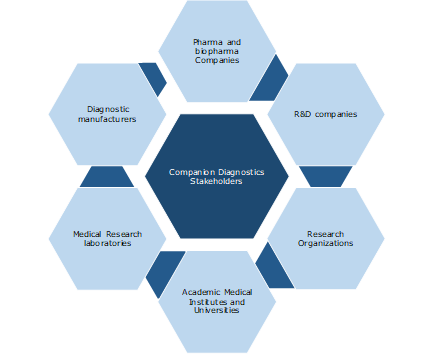

Key Stakeholders:

1 INDUSTRY OUTLOOK

1.1 Industry overview

1.2 Total addressable market

1.3 Industry Trends

2 Report Outline

2.1 Report Scope

2.2 Report Summary

2.3 Research Methodology

2.4 Report Assumptions

3 Market Snapshot

3.1 Market Definition – Infoholic Research

3.2 Importance of Companion diagnostics

3.3 Segmented Addressable Market (SAM)

3.4 Trends of the companion diagnostics market

3.5 Related Markets

3.5.1 Personalized medicine

3.5.2 Genetic testing Market 16

3.5.3 Point-Of-Care Diagnostics Market

4 Market Outlook

4.1 Overview

4.2 Regulatory Scenario

4.3 Market segmentation

4.4 PEST Analysis

4.5 Porter 5(Five) Forces

5 Market Characteristics

5.1 DRO – Global Companion Diagnostics Market Dynamics

5.1.1 Drivers

5.1.1.1 Growing incidence of cancer across the globe

5.1.1.2 Rising adoption of companion diagnostics tests

5.1.1.3 Growing demand of personalized medicine

5.1.2 Opportunities

5.1.2.1 Emerging applications of companion diagnostics

5.1.2.2 Growing demand for next-generation sequencing

5.1.3 Restraints

5.1.3.1 Uncertain reimbursement scenario in developed and developing countries

5.1.3.2 Lack of professionals to perform the test

6 Technology: Market Size and Analysis

6.1 Overview

6.2 Polymerase Chain Reaction

6.3 In Situ Hybridization

6.4 Immunohistochemistry

6.5 Next-Generation Sequencing

6.6 Others

7 Application: Market Size and Analysis

7.1 Overview

7.2 Cancer

7.2.1 Lung cancer

7.2.2 Breast cancer

7.2.3 Colorectal cancer

7.2.4 Melanoma

7.2.5 Others

7.3 Infectious disease

7.4 Others

8 End Users: Market Size and Analysis

8.1 Overview

8.2 Pharma and biopharma companies

8.3 Reference Laboratories

8.4 Others

9 Regions: Market Size and Analysis

9.1 Overview

9.2 North America

9.2.1 Overview

9.2.2 US

9.2.3 Canada

9.3 Europe

9.3.1 Overview

9.3.2 UK

9.3.3 Germany

9.3.4 France

9.3.5 Spain

9.4 APAC

9.4.1 Overview

9.4.2 India

9.4.3 China

9.5 Rest of the World

10 Competitive Landscape

10.1 Overview

11 Vendor Profiles

11.1 F.Hoffmann-La Roche Ltd

11.1.1 Overview

11.1.2 Business Unit

11.1.3 Geographic Presence

11.1.4 Business Focus

11.1.5 SWOT Analysis

11.1.6 Business Strategy

11.2 Qiagen N.V.

11.2.1 Overview

11.2.2 Geographic Presence

11.2.3 Business Focus

11.2.4 SWOT Analysis

11.2.5 Business Strategies

11.3 Abbott Laboratories

11.3.1 Overview

11.3.2 Business Unit

11.3.3 Geographic Presence

11.3.4 Business Focus

11.3.5 SWOT Analysis

11.3.6 Business Strategy

11.4 Myriad Genetics Inc.

11.4.1 Overview

11.4.2 Business Unit

11.4.3 Business Focus

11.4.4 SWOT Analysis

11.4.5 Business Strategy

11.5 Agilent Technologies Inc.

11.5.1 Overview

11.5.2 Business Units

11.5.3 Geographic Presence

11.5.4 Business Focus

11.5.5 SWOT Analysis

11.5.6 Business Strategies

12 Companies to Watch For

12.1 BioMerieux S.A.

12.1.1 Overview

12.1.2 BioMerieux S.A.: Recent Developments

12.2 Danaher Corporation (Leica Microsystems AG)

12.2.1 Overview

12.2.2 Danaher Corporation: Recent Developments

12.3 Resonance Health Limited

12.3.1 Overview

12.3.2 Resonance Health Limited: Recent Developments

12.4 Thermo Fisher Scientific

12.4.1 Overview

12.4.2 Thermo Fisher Scientific: Recent Developments

12.5 Genomic Health, Inc.

12.5.1 Overview

12.5.2 Genomic Health: Recent Developments

13 Annexure

13.1 Abbreviations

Research Framework

Infoholic research works on a holistic 360° approach in order to deliver high quality, validated and reliable information in our market reports. The Market estimation and forecasting involves following steps:

- Data Collation (Primary & Secondary)

- In-house Estimation (Based on proprietary data bases and Models)

- Market Triangulation

- Forecasting

Market related information is congregated from both primary and secondary sources.

Primary sources

involved participants from all global stakeholders such as Solution providers, service providers, Industry associations, thought leaders etc. across levels such as CXOs, VPs and managers. Plus, our in-house industry experts having decades of industry experience contribute their consulting and advisory services.

Secondary sources

include public sources such as regulatory frameworks, government IT spending, government demographic indicators, industry association statistics, and company publications along with paid sources such as Factiva, OneSource, Bloomberg among others.