Dental Lab Market by Indirect Restorative Materials (Metal-ceramics, Ceramics, and Other Indirect Restorative Materials), Equipment (Milling Equipment, Scanners, Furnaces, and Articulators), Prosthetic Type (Bridges, Crowns, and Dentures), Geography – Global Drivers, Restraints, Opportunities, Trends, and Forecast up to 2026

- August, 2020

- Domain: Healthcare - Health and Hygiene

- Get Free 10% Customization in this Report

Dental labs develop and modify several dental products to help to deliver oral health care services by a licensed dentist. These dental products include bridges, crowns, dentures, and other dental products. A prescription is followed by the dental lab experts from the licensed dentist while producing items such as denture teeth, implants as well as orthodontic devices. There are multiple factors such as drastic growth in the elderly population where toothlessness incidences are growing, growing dental care from developing markets, rising incidence of damage of teeth, and other dental diseases that are propelling the market growth. However, the expensive prices incurred in purchasing dental materials and devices are the significant reason which is holding back the growth of the dental laboratory market in the forecast period. Dental Lab Market is predicted to grow at a CAGR of 6.1% during the forecasting period.

Research Methodology:

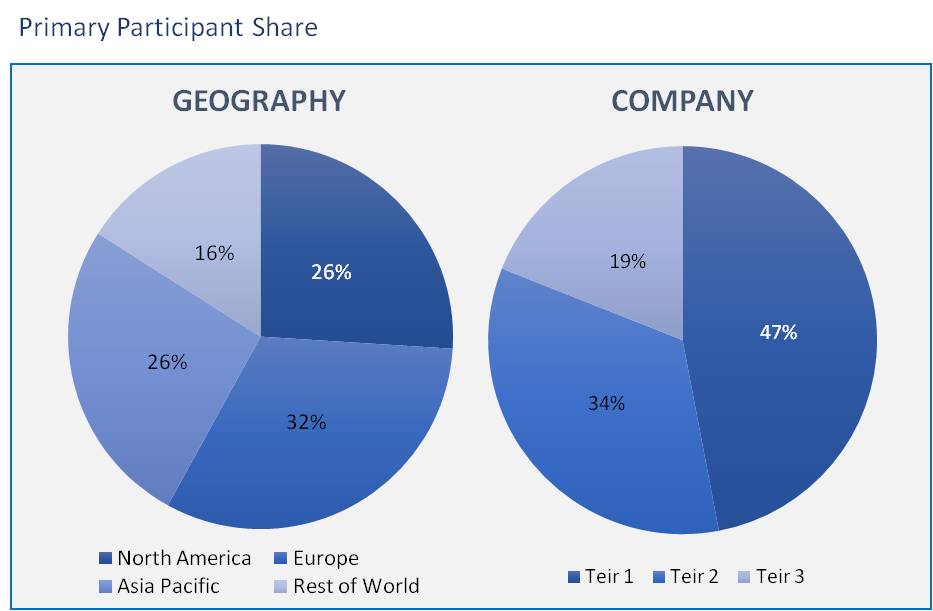

The dental labs market has been analyzed by utilizing the optimum combination of secondary sources and in-house methodology, along with an irreplaceable blend of primary insights. The real-time assessment of the market is an integral part of our market sizing and forecasting methodology. Our industry experts and panel of primary participants have helped in compiling relevant aspects with realistic parametric estimations for a comprehensive study. The participation share of different categories of primary participants is given below:

Dental labs market scope

Indirect Restorative Materials: Market Size & Analysis

- Metal-ceramics

- Ceramics

- Traditional All-ceramics

- CAD/CAM Ceramics

- Zirconia

- Glass Ceramics

- Other Indirect Restorative Materials

- Resins

- Non-ceramics

Equipment: Market Size & Analysis

- Milling Equipment

- Scanners

- Furnaces

- Articulators

Prosthetic Type: Market Size & Analysis

- Bridges

- Crowns

- Crowns & Bridges Materials

- Porcelain Fused-to-Metal (PFM)

- Traditional Ceramics

- CAD/CAM Ceramics

- Resins

- Full Cast

- Dentures

Geography: Market Size & Analysis

- North America

- Europe

- Asia Pacific

- Rest of the World

The indirect restorative materials segment is further divided into metal-ceramics, ceramics, and other indirect restorative materials. The ceramics segment is assumed to hold a larger position in the market growth, and the reasons for the growth are these ceramics are durable, high toughness in fractures compared to other materials.

Further, scanners are widely demanded equipment in the equipment segmentation as the demand for a digital dental product is more as well as demand for fast and effective treatment. There is a trend for computer-aided drawing in the present as the scanners are associated with the computer.

Moving to prosthetic type, the crown of prosthetic is majorly penetrating its position in dental lab market segmentation. The crowns are one type of prosthetic which is widely used for complete restoration of the single tooth, which is damaged as well as the increased procedures of single-tooth implant restoration.

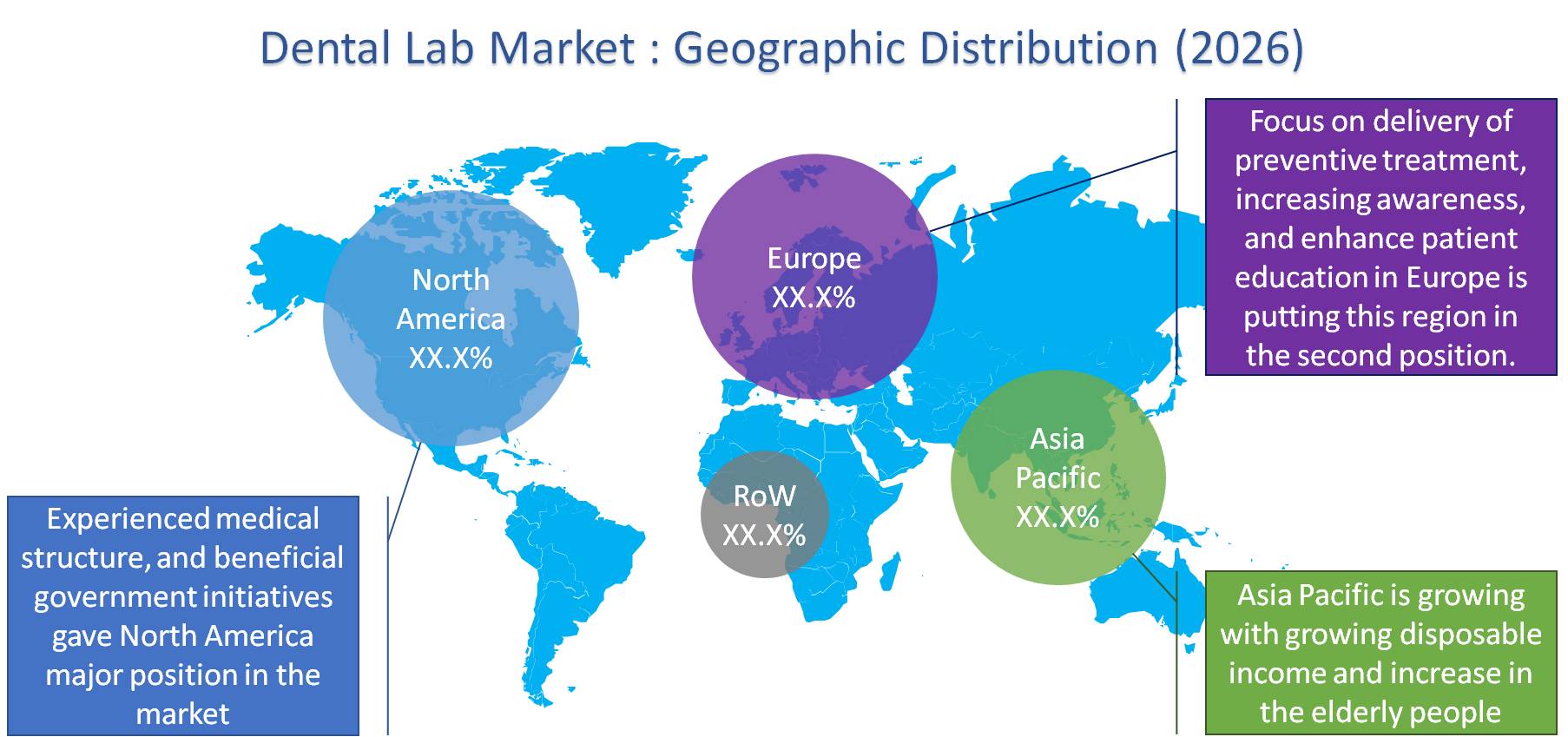

Further, moving to the regional analysis, North America is having a major position in the dental lab market share. North America has a worldly experienced medical structure, beneficial government initiatives associated with high expenditure on health in this region. On the other hand, the Asia Pacific region is the fastest-growing market share in the dental lab market since there is an increase in the elderly position.

The major factors which are pushing the global dental lab market growth are the globally increasing incidence of dental diseases such as dental caries where a tooth is damaged due to bacteria, and the growing population of old people increases the dental problems such as toothlessness. Moreover, CAD/CAM technologies are becoming the most desired technology for dental treatments, which is giving rise to opportunities for the dental lab market.

Few companies which are playing a key role are Zimmer Biomet Holdings, Inc., Dentsply Sirona Inc, Danaher Corporation, VITA Zahnfabrik H. Rauter GmbH & Co, 3M Company, Ultradent Products, Inc., Mitsui Chemicals, Inc, BEGO GmbH & Co. KG, Septodont Holding, IvoclarVivadent AG, GC Corporation, Kuraray Noritake Dental, Inc., Planmeca Oy, VOCO GmbH, and Shofu Inc.

Therefore, the dental lab market is penetrating its position in the world by its developed technology in the manufacturing of dental products for easy and fast dental treatment. This report gives a complete view of the dental lab market growth in terms of segmentation, drivers, and opportunities. This report also provides on few aspects which are creating challenges and restraints for the market growth.

- This research explains and estimates the global dental laboratories market by indirect restorative materials, equipment, prosthetic type, and geography.

- The complete analysis of the competitive edge for the advantage of the global market competitors where one can compete with other competitors.

- This research also presents the analysis of new product developments, mergers, and acquisitions, along with research & developments of the key vendors.

- The penetration of the dental lab market over the four geographical regions is also explained in this report.

1. Executive Summary

2. Industry Outlook

2.1. Industry Overview

2.2. Industry Trends

3. Market Snapshot

3.1. Market Definition

3.2. Market Outlook

3.3. PEST Analysis

3.4. Porter Five Forces

3.5. Related Markets

4. Market characteristics

4.1. Market Evolution

4.2. Market Trends and Impact

4.3. Advantages/Disadvantages of Market

4.4. Regulatory Impact

4.5. Market Offerings

4.6. Market Segmentation

4.7. Market Dynamics

4.7.1. Drivers

4.7.2. Restraints

4.7.3. Opportunities

4.8. DRO - Impact Analysis

5. Indirect Restorative Materials: Market Size & Analysis

5.1. Overview

5.2. Metal-ceramics

5.3. Ceramics

5.3.1. Traditional All-ceramics

5.3.2. CAD/CAM Ceramics

5.3.3. Zirconia

5.3.4. Glass Ceramics

5.4. Other Indirect Restorative Materials

5.4.1. Resins

5.4.2. Non-ceramics

6. Equipment: Market Size & Analysis

6.1. Overview

6.2. Milling Equipment

6.3. Scanners

6.4. Furnaces

6.5. Articulators

7. Prosthetic Type: Market Size & Analysis

7.1. Overview

7.2. Bridges

7.3. Crowns

7.3.1. Crowns & Bridges Materials

7.3.1.1. Porcelain Fused-to-Metal (PFM)

7.3.1.2. Traditional Ceramics

7.3.1.3. CAD/CAM Ceramics

7.3.1.4. Resins

7.3.1.5. Full Cast

7.4. Dentures

8. Geography: Market Size & Analysis

8.1. Overview

8.2. North America

8.3. Europe

8.4. Asia Pacific

8.5. Rest of the World

9. Competitive Landscape

9.1. Competitor Comparison Analysis

9.2. Market Developments

9.2.1. Mergers and Acquisitions, Legal, Awards, Partnerships

9.2.2. Product Launches and execution

10. Vendor Profiles

10.1. Dentsply Sirona Inc

10.1.1. Overview

10.1.2. Product Offerings

10.1.3. Geographic Revenue

10.1.4. Business Units

10.1.5. Developments

10.1.6. Business Strategy

10.2. Danaher Corporation

10.2.1. Overview

10.2.2. Product Offerings

10.2.3. Geographic Revenue

10.2.4. Business Units

10.2.5. Developments

10.2.6. Business Strategy

10.3. 3M Company

10.3.1. Overview

10.3.2. Product Offerings

10.3.3. Geographic Revenue

10.3.4. Business Units

10.3.5. Developments

10.3.6. Business Strategy

10.4. Zimmer Biomet Holdings, Inc.

10.4.1. Overview

10.4.2. Product Offerings

10.4.3. Geographic Revenue

10.4.4. Business Units

10.4.5. Developments

10.4.6. Business Strategy

10.5. Ultradent Products, Inc.

10.5.1. Overview

10.5.2. Product Offerings

10.5.3. Geographic Revenue

10.5.4. Business Units

10.5.5. Developments

10.5.6. Business Strategy

10.6. GC Corporation

10.6.1. Overview

10.6.2. Product Offerings

10.6.3. Geographic Revenue

10.6.4. Business Units

10.6.5. Developments

10.6.6. Business Strategy

10.7. Mitsui Chemicals, Inc

10.7.1. Overview

10.7.2. Product Offerings

10.7.3. Geographic Revenue

10.7.4. Business Units

10.7.5. Developments

10.7.6. Business Strategy

10.8. Planmeca Oy

10.8.1. Overview

10.8.2. Product Offerings

10.8.3. Geographic Revenue

10.8.4. Business Units

10.8.5. Developments

10.8.6. Business Strategy

10.9.1. Overview

10.9.2. Product Offerings

10.9.3. Geographic Revenue

10.9.4. Business Units

10.9.5. Developments

10.9.6. Business Strategy

10.10.1. Overview

10.10.2. Product Offerings

10.10.3. Geographic Revenue

10.10.4. Business Units

10.10.5. Developments

10.10.6. Business Strategy

11. Companies to Watch

11.1. Ivoclar Vivadent AG

11.1.1. Overview

11.1.2. Market

11.1.3. Business Strategy

11.2.1. Overview

11.2.2. Market

11.2.3. Business Strategy

11.3. Vita Zahnfabrik H. Rauter GmbH & Co

11.3.1. Overview

11.3.2. Market

11.3.3. Business Strategy

11.4. Kuraray Noritake Dental, Inc.

11.4.1. Overview

11.4.2. Market

11.4.3. Business Strategy

11.5. Shofu Inc

11.5.1. Overview

11.5.2. Market

11.5.3. Business Strategy

12. Analyst Opinion

13. Annexure

13.1. Report Scope

13.2. Market Definitions

13.3. Research Methodology

13.3.1. Data Collation and In-house Estimation

13.3.2. Market Triangulation

13.3.3. Forecasting

13.4. Report Assumptions

13.5. Declarations

13.6. Stakeholders

13.7. Abbreviations

Research Framework

Infoholic research works on a holistic 360° approach in order to deliver high quality, validated and reliable information in our market reports. The Market estimation and forecasting involves following steps:

- Data Collation (Primary & Secondary)

- In-house Estimation (Based on proprietary data bases and Models)

- Market Triangulation

- Forecasting

Market related information is congregated from both primary and secondary sources.

Primary sources

involved participants from all global stakeholders such as Solution providers, service providers, Industry associations, thought leaders etc. across levels such as CXOs, VPs and managers. Plus, our in-house industry experts having decades of industry experience contribute their consulting and advisory services.

Secondary sources

include public sources such as regulatory frameworks, government IT spending, government demographic indicators, industry association statistics, and company publications along with paid sources such as Factiva, OneSource, Bloomberg among others.